Microsoft Stock Forecast: Apple’s Blunder In MacBook Pro Will Boost Microsoft’s Surface Computer Sales

![]() The article was written by Motek Moyen Research Seeking Alpha’s #1 Writer on Long Ideas and #2 in Technology – Senior Analyst at I Know First.

The article was written by Motek Moyen Research Seeking Alpha’s #1 Writer on Long Ideas and #2 in Technology – Senior Analyst at I Know First.

Microsoft Stock Forecast: Apple’s Blunder In MacBook Pro Will Boost Microsoft’s Surface Computer Sales

Summary:

- The Christmas holiday shopping period is almost here. I predict that Microsoft will post more than $1 billion in Surface computer this Q4 2016.

- Apple’s bold decision to remove consumer stand ports like the SD cart slot, regular USB Type-A ports, and HDMI in the new MacBook Pro raised complaints.

- Backlash from professional photographers, video editors, and content creators angry from Apple’s removal of important peripheral ports could help boost sales of the Surface Pro 4 and Surface Book.

- Microsoft needs more revenue from its Surface brand to make up for its abandonment of the Lumia phone hardware business.

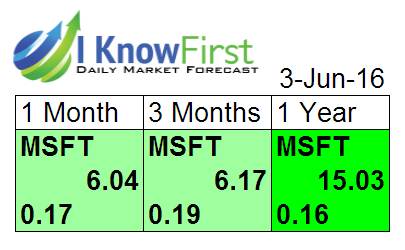

- Microsoft’s stock has buy signals from short and medium-term algorithmic forecasts

- Past I Know First Algorithm Forecast Performance on MSFT

The terrible backlash from Apple’s (AAPL) decision to remove standard ports in the new MacBook Pro is a boon for Microsoft’s (MSFT) Surface Book and Surface Pro 4 products. The MacBook Pro 2016’s lack of a touchscreen display is already a disadvantage against Microsoft’s deluxe laptop products. Apple removing very important peripheral ports like the SD card slot, USB Type-A ports, and HDMI output has definitely alienated many loyal MacBook Pro users.

Photographers, video editors, graphic designers are mad that their pricey set of Type-A USB and FireWire-only cameras, scanners, printers, camcorders, Wacom tablets, external drives and other expensive peripherals are no longer compatible with the new USB Type-C and Thunderbolt 3 ports of the MacBook Pro 2016.

Apple’s Mistake Is Microsoft’s Gain

The offer of discounted dongles from Apple is not going to extinguish the disgust felt by Mac users who felt betrayed. Dongles or cables to enable Type-A USB peripherals to be used in a Type-C USB ports are unnecessary expenses. They are also inconvenient to carry around for content creators who need to transfer images from DSLR cameras to their laptops.

Yes, it is true that UBS Type-C offers faster transfer rate but all the peripherals today still use the older Type-A USB 2.0 or 3.0 standard. Microsoft’s Surface Book wisely still includes Type-A USB 3.0 and SD card slots. Microsoft is smart enough to realize that it will take a few more years before the computer peripherals industry to make printers, scanners, cameras, and camcorders with Type-C connectors.

Instead of a designer buying a $2,399 MacBook Pro 2016 that cannot connect with his DSLR/scanner, he or she might opt to buy the $2,799 Surface Book 2016. Microsoft has obvious economic benefits if it could improve its estimated 1 million units/quarter Surface computer sales. The possibility that 50,000 (or 500,000) angry MacBook users switching to Microsoft’s flagship laptop product could result into new sales of $139.95 million this Christmas shopping season.

Tens of millions of photographers and videographers need the integrated SD card slot and HDMI out ports for their daily needs. As far as I know, no DSLR and camcorder has Type-C connectors yet.

Why It Matters

Anything that improves the market appeal of Surface computers is a catalyst for Microsoft’s stock. Winning the support of angry MacBook users means Microsoft can generate more Surface revenue. The more revenue from Microsoft’s own brand of computers, the more money it could use to offset its $7.6 billion write-off of the Lumia phone hardware business.

I firmly believe that Microsoft’s future as a hardware vendor now lies solely in its Surface brand of computers. As long as Nadella is CEO, we can no longer expect Microsoft to try a comeback in smartphone hardware.

Microsoft’s newhardware focus is to steal customers away from the high-end Mac business of Apple. This objective is easier done when Apple itself is making design choices that alienates its current customers. If Apple dares to also release new iMac and Mac Pro without USB Type-A and HDMI out ports, I expect Microsoft to double its 1 million units/quarter sales of Surface computers within the next two years.

Microsoft’s recent release of the Surface Studio desktop PC is a strong clue that it wants to also diminish the high-end iMac and Mac Pro business of Apple. Look at the image below, Microsoft clearly created a touchscreen-equipped version of the iMac with its Surface Studio computer. Again, Microsoft knew what the customers need. The Surface Studio has four Type-A USB 3.0 ports and SD card slot.

(Source: Microsoft)

Conclusion

Nadella cannot rely on cloud computing revenue for the long-term prosperity of Microsoft. Not every computing or daily tasks can be accomplished in the cloud. People will still need on-site computers in their homes and offices. Microsoft therefore still needs a healthy, growing PC hardware business to diversify its future revenue streams.

I rate MSFT as a better buy than AAPL right now. Microsoft still respects the needs of its consumers. Apple, by its callous removal of necessary computer peripheral ports, revealed it favors its design principles over current customer needs. Making loyal customers angry is a terrible business practice that has long-term side-effects.

My 90-day price target for MSFT is $65. This is higher than the $64 price target of TipRanks-tracked Wall Street Analysts. My higher optimism is because I understand the future market boost from Microsoft possibly increasing its Surface computer sales at the expense of Apple’s Mac business.

(Source: TipRanks.com)

My buy rating for MSFT is also backed by the positive market trend signals from I Know First. Microsoft’s stock has a higher probability of going up in price than it going down within the next 90 days.

Past I Know First Algorithm Forecast Performance on MSFT

In accordance with the prediction, MSFT gone up 15.22% compared to the forecast issued on June 3, 2016. To read more about the past prediction, click here.