NVDA Stock Prediction: Intel’s Denial That It Will License AMD Graphics Chip Is Great News For Nvidia

![]() The article was written by Motek Moyen Research Seeking Alpha’s #1 Writer on Long Ideas and #2 in Technology – Senior Analyst at I Know First.

The article was written by Motek Moyen Research Seeking Alpha’s #1 Writer on Long Ideas and #2 in Technology – Senior Analyst at I Know First.

NVDA Stock Prediction

Summary:

- The previous six-year (2011 to 2016) graphics technology patent licensing deal with Intel was worth $1.5 billion to Nvidia.

- It is therefore a blessing that Intel recently denied it was licensing graphics chip technology from Advanced Micro Devices.

- Intel clearly still favor graphics chip technology of Nvidia over AMD’s Radeon.

- Nvidia has obvious long-term economic benefits from Intel’s continued use of Nvidia graphics chip technology.

- The near and long-term I Know First algorithmic forecasts are in favor of going long on NVDA right now.

The $1.5 billion six-year graphics chip licensing deal with Nvidia (NVDA) expired last March. Three days ago, tech-centric website Fudzilla published an article claiming Intel (INTC) is licensing graphics chip technology from Advanced Micro Devices (AMD). Fortunately for NVDA investors, an Intel spokesperson refuted Fudzilla’s claim. Intel’s straight-up denial that it is licensing graphics chip technology from AMD is a welcome news to all NVDA shareholders.

The annual $200 million to $300 million of easy money that Nvidia gets (from Intel licensing its graphics technology) is likely to continue for many years to come. I suspect that Nvidia and Intel are again negotiating a fresh six-year deal that will let Chipzilla keep on using Nvidia graphics technology for its Intel HD and Iris Graphics embedded GPU products. Intel’s denial of Fudzilla’s write-up revealed Intel still prefers/trusts Nvidia’s GeForce GPU chip technology over AMD’s Radeon. Retaining the graphics chip technology licensing business from Intel is one more reason to keep holding on (or to buy more) NVDA shares.

Going forward, Nvidia is most likely to get favorable stock market sentiments when Intel keeps using its graphics chip technology. NVDA already has a YTD gain of almost 20%. I’m highly confident this stock could yield more gain before 2017 ends. A new graphics chip licensing with Intel will reinforce the public perception that Nvidia still leads AMD when it comes to GPU chip development.

An official announcement from Intel and Nvidia of a new graphics chip technology licensing deal could boost NVDA stock beyond the $140 price level.

Intel Has The Lion Share in GPU Shipments

Intel’s embedded or integrated GPU products helped it corner the lion share (65.1% share) in total GPU shipped year. The long-term outlook of Nvidia is therefore promising when we take in to account that more than 80% of new computers are using GeForce graphics chip technology.

(Source: Jon Peddie Research)

The more Intel-powered PCs that get sold, the bigger user population there is that rely on Nvidia-made graphics technology. The more people around the world that gets accustomed to GeForce GPU experience, the harder it becomes for AMD to return to profitability.

Furthermore, the PC market is finally posting positive growth. PC sales is the main growth driver of GPU sales. Intel will likely supply more of its processors with Nvidia-based embedded GPUs to PC manufacturers for the next two or three years. Intel is therefore unlikely to rock the boat by ditching Nvidia graphics technology now in favor of AMD’s Radeon.

Conclusion

My explanation why there is not yet an official announcement of a new Intel-Nvidia Graphics chip technology licensing deal is that Nvidia is likely negotiating for more money. Nvidia deserves a better deal than the old $1.5 billion, six-year deal that ended last March.

My takeaway is that Nvidia could get a $2 billion, six-year licensing deal from Intel this year. Intel obviously need the updated GPU chip technology from Nvidia to keep its integrated graphics acceptable to PC manufacturers and end-users.

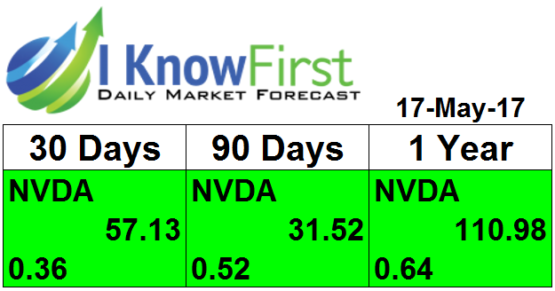

My buy rating for NVDA is echoed by the positive market trend signals from the near and long-term algorithmic forecasts of I Know First. As you can see from the chart below, going long on NVDA now is decisive.

Nvidia’s stock is a compelling buy opportunity based on its one-year algorithmic forecast. The stock’s market trend signal is over 100. The predictability factor is higher than 0.50.

Furthermore, 20 Wall Street analysts tracked by TipRanks still rate NVDA as a Moderate Buy. Only 3 analysts rate NVDA as a Sell. When it comes to the fickle market of stocks, it is often safer to join the bigger herd of thought.

On a side note, may I tout that I am still among the top 25 best financial bloggers tracked by TipRanks. On a one-year-return basis, my 98% accuracy/success rate is also the best among all TipRanks-tracked financial bloggers and Wall Street Analysts. My +32.7% average return per buy recommendation on a one-year basis is also the best among all bloggers and analysts tracked by TipRanks.

Source: TipRanks

Past I Know First Success With NVDA

In such as the one dated on June 21, 2016, the algorithm accurately forecast a signal for NVIDIA. Within a year time span, the stock rose impressively by 168.54%, beating the S&P 500 return of 13.46%. The market premium calculates to an astounding 155.08%.

I Know First Algorithm Heatmap Explanation

The sign of the signal tells in which direction the asset price is expected to go (positive = to go up = Long, negative = to drop = Short position), the signal strength is related to the magnitude of the expected return and is used for ranking purposes of the investment opportunities.

Predictability is the actual fitness function being optimized every day, and can be simplified explained as the correlation based quality measure of the signal. This is a unique indicator of the I Know First algorithm. This allows users to separate and focus on the most predictable assets according to the algorithm. Ranging between -1 and 1, one should focus on predictability levels significantly above in order to fill confident about/trust the signal.