Plug Power Rise: Is Hydrogen Fuel The Answer?

![]() The article was written by Jacob Saphir, a Financial Analyst at I Know First.

The article was written by Jacob Saphir, a Financial Analyst at I Know First.

Plug Power Rise

“The sooner we get started with alternative energy sources and recognize that fossil fuels makes us less secure as a nation, and more dangerous as a planet, the better off we’ll be.” Lindsey Graham, US Senator of South Carolina.

Summary:

- What is hydrogen fuel cell and how does it affect us?

- Improving Fundamental

- Growth in Overseas Expansion and Political Factor

- I Know First Algorithm forecast for PLUG

Background:

Plug Power, Inc. (PLUG) is hydrogen fuel cells development company founded in 1997 and headquartered in Latham, New York. The business operations are to design, manufacture, and commercialize proton exchange membrane fuel cells that combines oxygen and hydrogen to produce electricity. As the world looks for sustainable energy, companies are searching for alternative energy source not only to meet environmental regulations but also to decrease cost in overhead expenses. Plug Power visions itself to be a leader in providing alternative energy for their customers by replacing hazard disposal lead-acid batteries with its product line of GenDrive fuel cells. These products can be found in forklifts, material handling and off-road industrial vehicles. This results in providing customers with reliable, long lasting emission free power source. With customers such as Coca Cola, Walmart, BMW, and P&G incorporating this technology to be used in their distribution sites, more will see hydrogen fuel cell as the future in sustainability. As we review Plug Power’s improving fundamental and its potential growth, I Know First maintains a bullish forecast.

Improving Fundamental:

Although the company has not report a net income in the past 5 years and has missed both its estimate quarterly earnings per share since the start of the year, the financials may be showing signs of optimism. The chart on the left reveals negative earnings per share and cash flow. However, its posted loss has decreased by 61% since the past 2 years. Sales have been increased from $27 million to $103 million since 2013. Between the years of 2014 and 2015, sales increased by over 60% alone. Sales per share has increased from .35 in 2013 to .59 in 2015. That is a 69% increase. After releasing its quarterly earnings since the start of the year, the company currently has $135 million dollars in booking. The company appears on track to achieve its ambitious goal of $275 million dollars in sales by the end of the year. If the company can continue improving its fundamentals towards reporting a net income, its stock price may one day reach at level shareholders enjoyed in the year 2014, after the stock increased by over 400%. Such a stock price must be accomplished with growth.

Although the company has not report a net income in the past 5 years and has missed both its estimate quarterly earnings per share since the start of the year, the financials may be showing signs of optimism. The chart on the left reveals negative earnings per share and cash flow. However, its posted loss has decreased by 61% since the past 2 years. Sales have been increased from $27 million to $103 million since 2013. Between the years of 2014 and 2015, sales increased by over 60% alone. Sales per share has increased from .35 in 2013 to .59 in 2015. That is a 69% increase. After releasing its quarterly earnings since the start of the year, the company currently has $135 million dollars in booking. The company appears on track to achieve its ambitious goal of $275 million dollars in sales by the end of the year. If the company can continue improving its fundamentals towards reporting a net income, its stock price may one day reach at level shareholders enjoyed in the year 2014, after the stock increased by over 400%. Such a stock price must be accomplished with growth.

Growth in Overseas Expansion and Political Factor:

A company’s growth can be attributed to technology and political change. Research have found hydrogen fuel cells to last longer than its predecessor, lead-acid batteries. Plug Power concentrates most of its business in North America. The compound annual growth rate is projected 21.5% for the next four years. As a leading innovator in alternative energy, the company has the potential to expand overseas into the European and Asian market. According to investorguid.com, the estimated market in Europe is over $17 billion, while in Asia it is $12.4 billion. During the company’s second quarter earnings, Plug Power looked abroad in France and signed a sales agreement with Carrefour, the second largest retailer in the world. The reoccurring theme of reducing our dependence in foreign oil or other conventional energy sources that may be harmful to the environment, might find hydrogen fuel cells to be the answer. The benefit to this technology are no emission and hydrogen is one the simplest and most abundant element on earth. Before President Obama leaves office, he made climate control an important factor during his presidency. On August 2015, the White House set greenhouse gas emissions to be cut by 28% by 2030 as compared to 2005.

Conclusion:

We are maintaining a bullish forecast of the stock. I Know First’s algorithm forecast the stock as a long term investment.

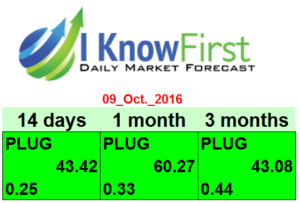

The forecast is color-coded, where green indicates a bullish signal while red indicates a bearish signal. Brighter greens signify that the algorithm is very bullish as it does at the top of this forecast. The signal is the number flush right in the middle of the box and the predicted direction (not a specific number or target price) for that asset, while the predictability is the historical correlation between the prediction and the actual market movements. Thus, the signal represents the forecasted strength of the prediction, while the predictability represents the level of confidence. The algorithm generates daily market predictions for stocks, commodities, ETF’s, interest rates, currencies, and world indices for the short, medium and long term time horizons.

Past I Know First Forecast Performance on PLUG

In such as the one dated on February 12, 2016, the algorithm accurately forecast a bullish signal for Plug Power. In nearly a 14-days time span, the stock rose by 25.47%, beating the S&P 500 return of 6.69%. This translates to a market premium of 18.78%. In another case, the forecast accurately predicated the stock would increase from its given forecast date of January 31, 2016 for one month and three month. Each had a return of 10.07% and 10.16%.

If we were to compare the forecast back in January 31, 2016 to the latest forecast I Know First algorithm released as of October 9, 2016, we can see both forecasts rate Plug Power as a buy. The confidence level for the 3-months forecast is higher than the level as its previous forecast. If the previous forecast last January accurately predicted the stock would increase, the confidence level registered in the latest forecast could indicate another bullish return.

This bullish forecast on Plug Power sent to I Know First subscribers on January 31, 2016.