Stock KO: Coca-Cola Is Re-Gaining Its Fizz

The article was written by Moises Meir, a Financial Analyst at I Know First.

The article was written by Moises Meir, a Financial Analyst at I Know First.

Coca-Cola Stock Analysis

Summary

- Coca Cola’s Transformation Into a Healthier Company

- Stock and Financial Performance

- Expert Analysis & Bullish Forecast

Last Wednesday, The Coca Cola Company (KO) released its 2017 Q2 report to the public and it exceeded Wall Street’s expectation once again. Earnings per share ($0.59) and revenue ($9.70B) were both higher than the analyst’s forecast and there are many reasons to believe that this trend will continue in the future. The soda giants are still the leading company in the trillion-dollar industry of Beverages.

Coca Cola’s Transformation into a Health Conscious Company

The 2017 Q2 report was the first under the leadership of new CEO James Quincey. Since he was appointed CEO on May 1st, he made a clear point that Coca Cola has to make significant changes to its business model. Quincey stated that Coca Cola has to become more experimental and “shake off the culture of cautiousness” that they have had in the past couple years. The biggest hurdle for Quincey was to respond to the increasing demand for healthier beverages (and reduced demand for suagry drinks).

Quincey wasted no time regarding this matter, and expressed that he wants to make Coca Cola a “total beverage company” indicating that he expects the company’s soda sales to represent less than 50% of their sales by volume. Since these comments, there has been a great deal of capital invested in their juice, tea and milk segments. Their soda segment has also been improving on its “healthiness” as they have focused on boosting smaller-sized packages and also their new product Coca Cola Zero Sugar that will replace Coke Zero in the market.

The new management is also dealing with the massive cost-cutting initiative that started a few days before Quincey’s appointment. 1200 employees were sent home in a move that is expected to save $800 million in its effort to reduce costs. The CEO stated that they expect to reinvest “at least half of it” which is good news for both shareholders and potential investors.

Stock and Financial Performance

The Coca-Cola Company commands a strong market position due to its global reach, strong brand power offering an ever-growing choice of quality beverages, expanding international presence, a solid global bottling network and an impressive cash position. Its wide portfolio of sparkling and still beverages has allowed it to consistently gain volume and value share in the beverage market.

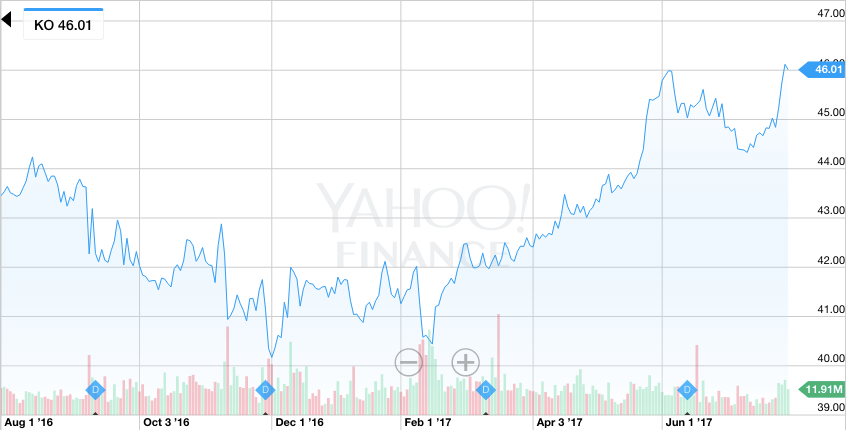

Coca Cola’s stock has been on an excellent track year to date. The stock was trading at $41.80 at the beginning of 2017 and has increased 10.07% to $46.01 (as of July 30th). The stock price today is the second highest of the year (with the highest being $46.12 per share on June 27th, 2017) and many signs point towards the stock improving more and more.

(Source: Yahoo! Finance)

July 26th, 2017 report is the source of most signs that KO has witnessed a jump of 3% in organic revenue growth for the quarter. It was driven by a 3 point positive change in the price/mix, showcasing Coca Cola’s pricing power. There was also significant growth in all but one developed markets (Latin America). Its comparable operating margin increased by almost 380 basis points. This improvement was driven by the divestiture process of the low-margin bottling business, and better expense management through productivity initiatives.

It is worth noting that all of these improvements occurred with two huge obstacles on the way. The first one being the refranchising of its bottling operations. This move has taken away significant capital and manpower, hurting the structure of the company. However, the project is soon to be completed and is expected to drive as much as 18% increase in the top line of the balance sheet. The second obstacle was the currency fluctuations. For the past quarter the fluctuations worked against Coca Cola, hurting revenue by 3%. Both of the obstacles are likely to disappear by the next report, as the refranchising will be over soon and the currency exchange market is likely to be steadier in the coming months.

I Know First’s Bullish Forecast

There are plenty of reasons to be optimistic about the future for Coca Cola, whether it be their willingness and flexibility to adapt to consumer’s demand, its cost cutting initiative or its excellent recent performance. For this reasons investors see KO as a respected brand with a leading marketing team that markets products that have no seasonality. It is simply a formula for success.

Following the Q2 report, 10 of the 27 (37%) analysts that cover KO had a “buy” rating for the stock. 16 had “hold” and just one had “sell”. The target price was also raised by most “buy” analysts. Notables were Credit Suisse raised it to $50 from $49 and Morgan Stanley that raised it to $47 from $45. The 12 month average target price for KO is 47.68 which gives an upside potential of about 3.63%.

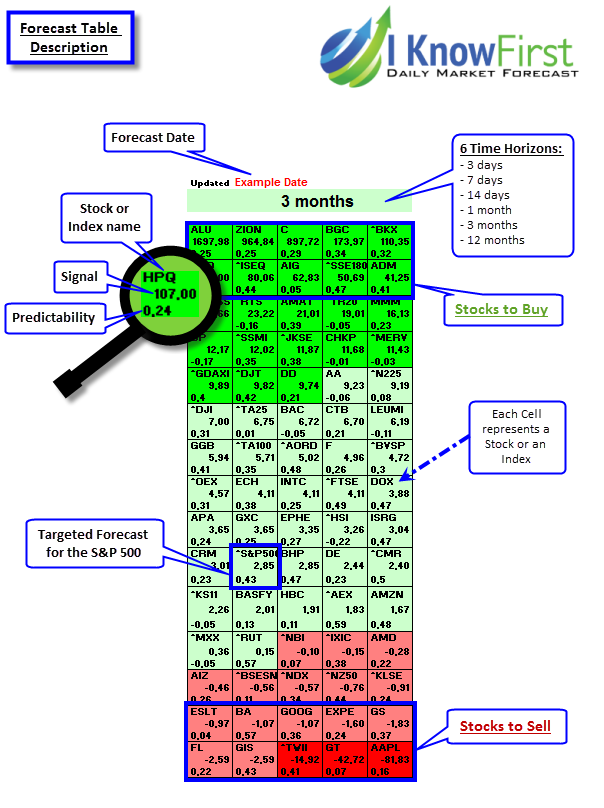

I Know First’s latest forecast is in line with all of the healthy financial signs and the analysts opinion, as the algorithm published a bullish forecast for The Coca Cola Company. The forecast suggests the investor to take a long position with the stock and recommends to hold it, as the signal strength and predictability both increase in the long run.

I Know First Algorithm Heatmap Explanation

The sign of the signal tells in which direction the asset price is expected to go (positive = to go up = Long, negative = to drop = Short position), the signal strength is related to the magnitude of the expected return and is used for ranking purposes of the investment opportunities.

Predictability is the actual fitness function being optimized every day, and can be simplified explained as the correlation based quality measure of the signal. This is a unique indicator of the I Know First algorithm, allowing the user to separate and focus on the most predictable assets according to the algorithm. Ranging between -1 and 1, one should focus on predictability levels significantly above in order to fill confident about/trust the signal.