Stock Forecast Success On Air: News 13 Channel Visits I Know First And Builds Winning Portfolio

This article was written by the I Know First Research Team.

This article was written by the I Know First Research Team.Tel-Aviv, a beautiful city on Israel’s coastline, is home to many an ambitious start-up seeking to revolutionize the world through advanced tech and sophisticated know-how. Israel, after all, is known as the Start-Up Nation, its ingenuity and high-tech savvy proven by success stories like Riskified and Wix. But in early September 2019, it was I Know First, a Tel Aviv-based AI stock forecast company, that Israeli News 13 TV channel visited to shoot a story for the broadcast. The idea was to find out if the company lived up to its promise of delivering accurate stock market forecasts, relying on an advanced AI.

Spoiler alert: it did.

Challenge Accepted

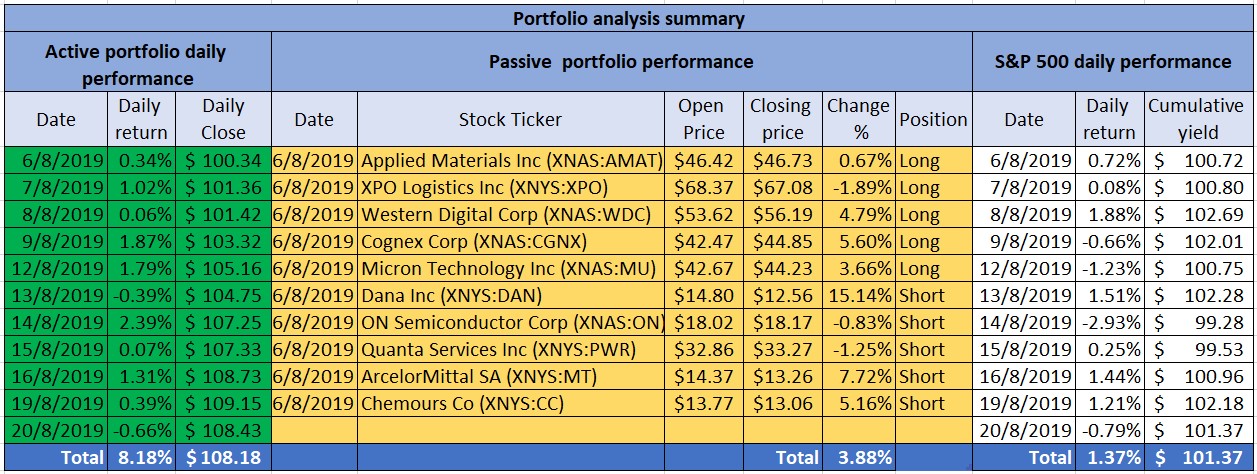

The idea for the story was quite simple: the journalists would show up at the company’s Tel Aviv office, get a short brief about I Know First and its predictive stock forecast AI and then try to build two portfolios using the AI predictions. More specifically, the Top 20 stock picks package would be used for the experiment. The first portfolio would be built for passive investment, which would just stay untouched throughout the review period, and the other – for active investment, which would see buy and sell orders placed on a daily basis. Then, the journalists and third-party experts, whose insights would add to the objectivity of the test, would see how the two portfolios perform and whether they would beat the S&P500 index.

Of course, both portfolios were to be virtual, with no real transactions happening. The idea, after all, was to test the AI’s capabilities, not to set up a private investment fund under the guise of a TV show. What would come from this, however, was a reliable simulation of investing with the help of the I Know First AI.

With late August-early September selected as the review period, the stock forecast algorithm was in for a tough test. As everyone with even the minimal exposure to the market must have already noticed, the current days are marked by increased volatility coming on the back of the tensions between the US and China, fears of a possible recession in the making and the ongoing turmoil in Hong Kong. All this meant that the algorithm’s task would be even harder than one could think.

The selection process for the stocks to pick for the passive portfolio, as well as those to long and short as part of the active one, was quite simple. With access to the 20 top stocks picked by the I Know First AI, the journalists picked out the stocks that had the best signal to predictability ratio for longing and shorting. As easily as that, the two portfolios were created, and the experiment went to the next phase.

After two weeks, the passive investment portfolio, the one that required no further input on behalf of the holder, was 3.88% up in value. The active one showed an even more impressive performance, going 8.18% up in value, generating two times as much as the passive investment set and beating the S&P 500 index by a wide margin as it only gained 1.37% in the review period. If we take into account the fact that the two portfolios were created by people who are not professional investors, the result is more than worthy of respect. With a little help from the stock forecast AI, the journalists managed to beat the volatile market, and the AI nailed the test.

Tal Mofkadi, a PhD with the Interdisciplinary Center in Israel’s Herzlia hired as an independent investment expert by News 13 channel to assess the two portfolios, was also impressed with their performance, calling it “magnificent”.

I Know First Stock Forecast AI Algorithm

So how does this work, you may ask, and can I do the same? Yes for the latter – that is as easy as finding a reliable broker and subscribing to I Know First forecasts here – but the former question begs a more in-depth discussion.

As noted in the report, the I Know First stock forecast AI Algorithm was trained on a dataset covering 15 years of trading. What this means is that the machine was processing market data and looking for patterns and trends in it, effectively learning to model the markets and their behavior. Then, processing the fresh market data, it fine-tuned its own models, keeping track of its own successes and failures. This was achieved by incorporating elements of genetic programming in its design. Such an approach also ensures that the stock forecast algorithm attunes itself to any market conditions.

The deep learning-based algorithm currently delivers forecasts for over 10,500 financial instruments, including stocks, indices and ETFs. Deep learning is a term that refers to a special subgroup of algorithms known as neural networks. A neural network approximates the way the human brain works through advanced maths. It is comprised of layers of nodes, or weights, that transform the input to generate an output. Deep neural networks normally have multiple hidden layers between input and output layers, which means that the data goes through more transformations along the way.

Each stock forecast is delivered as an easily interpretable heatmap with two numeric indicators: signal and predictability. Signal works as a relative measure for the estimated difference between the current price of the asset and the price that the algorithm assesses to be fair. A strong positive signal means the asset is expected to rise, while a strong negative one is a promise of a decline. Predictability shows how precisely the AI algorithm has been predicting this asset before. This metric is an adaptation of the Pearson correlation coefficient, ranging from -1 to 1, and is calculated as the correlation between earlier forecasts and actual price movements, weighted to give the more recent forecasts more importance. Any value of P above zero indicates a positive predictability, the higher the better

The AI also draws on chaos theory to account for market volatility. Its forecasts cover time horizons ranging from 3 to 365 days, which makes it suitable both for speculative trading and long-term investment. In a string of recent evaluations like this one, it demonstrated an accuracy of around 60% for 3-day predictions, rising up to 80-90% for 3-month forecasts, which is more than enough to generate consistent profits.