AI Anticipates Which Sectors Will Perform Best During Coronavirus Pandemic

This article about AI sectors definition during Coronavirus pandemic was written by Gabriel Plat, a Financial Analyst at I Know First.

This article about AI sectors definition during Coronavirus pandemic was written by Gabriel Plat, a Financial Analyst at I Know First.

Summary:

- COVID-19 is still affecting the economy. Transport has seen losses of over 77% since the start of the pandemic;

- Movie producers and operators are suffering from quarantine impositions. Stocks of Universal Studios, Disney, and AMC all dropped over 20% in the last six months;

- E-commerce appeared as a huge opportunity to profit during these times. Shopify stock rose 254% this semester, indicating how well the sector is right now;

- I Know First algorithm predicted one year ago the bullish trend of Shopify, giving investors to enjoy this trend much earlier than expected.

The COVID-19 Is Still Damaging Stock Markets

Atypical times do not happen frequently. It is hard to predict when or where they will show, but in fact, they are inevitable. For now, the coronavirus pandemic has pulled the trigger for a complete hit on the stock market.

One good way to understand where to invest in today’s situation is knowing where you should not put your money on. As I said in March, there are threats and opportunities in the situation we are dealing with at this moment. Even though we can see some recovery in stocks’ prices and indexes, most of them are still below the price they have started the year with. The automotive sector is a good example of it.

We can see above how different automotive stocks plunged since the beginning of the year. General Motors (GM) and Ford (F) suffered the biggest hits, while Toyota (7203.T) and Honda (7267.T) shared the same fate. Though they are now slightly better than where they were in early April, the loss of value of its stocks is at least 17% since January.

The airlines sector also suffered a massive hit since the start of the pandemic. United States companies such as American Airlines (AAL), United Airlines (UAL), and Delta (DAL) dropped above 66%, while the German company Lufthansa (LHAG) fell to almost 58% in the last six months.

The transportation sector is not the only one that has been having these kinds of struggles as we can see the same happening in the movie sector, for example. Not only film producers such as Universal Studios (UVV) and Disney (DIS) saw their stocks drop, but also movie operators such as AMC. Its stocks dropped over 20% in the last six months, while AMC stock suffered the most: 50.43%.

E-Commerce is Hitting The Jackpot

Of course, the market does not only consist of bad news. In my recent articles, I talked about different sectors that appeared as good opportunities to profit. On March 19, I discussed that streaming services could have their stocks increasing value. On April 15, I focused on medical stocks and which ones are getting closer to a treatment or vaccine for the COVID-19, resulting in better opportunities in the stock markets. Also, this article on March 26 talked about Warren Buffet’s buy-and-hold strategy, an investment strategy that can be very useful during these times.

Right now, we can see not only these areas as an opportunity to keep investing but also one that is getting more attention: delivery services. Because of the pandemic, people were (and most of them still are) forced to stay at home as much as they can. This is limiting not only the capacity of the consumers to buy products, but also companies to work properly.

When commerce is being limited, it is time for e-commerce to profit. Shopify, one of the biggest companies in this area, is seeing a huge boost in its stock. Over the last six months, Shopify stock (SHOP) jumped from 427 dollars to $1,027, an incredible increase of almost 254%.

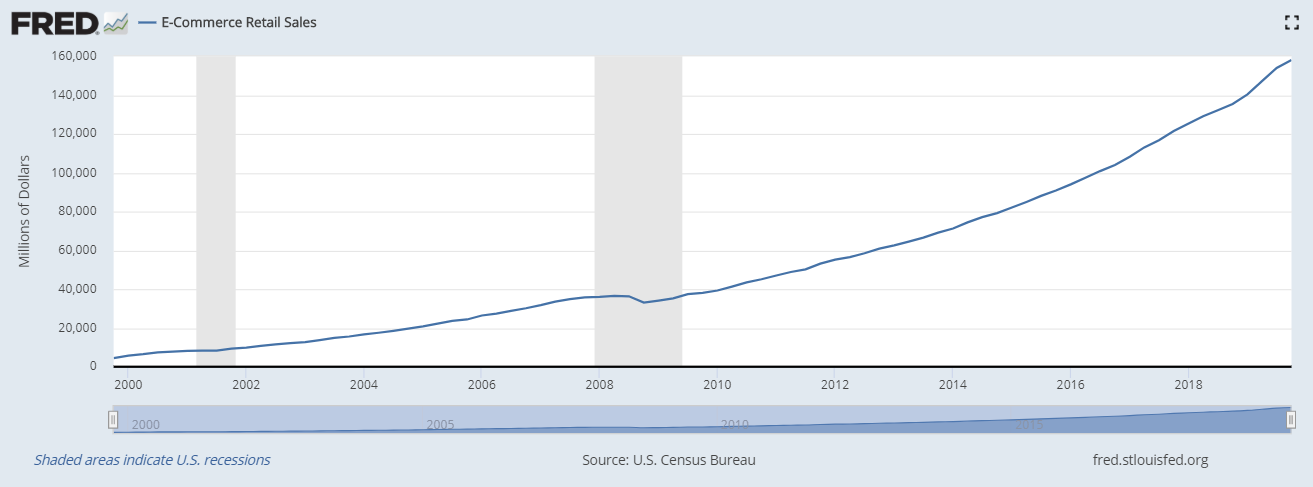

Shopify is a good example, but e-commerce as a whole is also taking advantage of the situation we are in. The sector is growing more and more in the last few years, as shown in the chart below and there is nothing to stop this trend to continue. In fact, it is the exact opposite, since we can expect the retail sales to be even higher in the first and second quarters of 2020.

Understanding Artificial Intelligence

We have been hearing about Artificial Intelligence or simply AI for a long time. Even though it sounds like robots acting like humans in sci-fi movies, AI is basically replicating human intelligence into machines. When they are programmed to learn and take action based on their previous knowledge, AI is capable of generating great results in several areas. Of course, the finance world is not out of this.

The AI-powered algorithm of I Know First is exactly what is mentioned above. By using decades of stock market data around the world, the algorithm can understand market trends and generate predictions of stock movements. This topic may sound utopian or simply unrealistic, but is not only true as the accuracy of the forecasts is very good.

The biggest example we can give is Shopify. The algorithm predicted one year ago that SHOP had a bullish outlook. The results are being seen today and people who used this and other AI predictions to invest in the stock market managed to profit amid the Coronavirus pandemic. In other words, trusting in AI helped investors to profit in the middle of an economic crisis.

Also, the algorithm provides forecasts for different assets, currencies, bonds, and indexes.

In the forecast above, the AI prediction package focused on stock market opportunities during Coronavirus times predicted correctly the movement of all 10 stocks in the 1-month horizon. The return of the average was over 10 times higher than the S&P 500 in the same period, indicating how good the stock market predictions are.

Conclusion

The market is not yet fully recovered from the Coronavirus pandemic. Even though we are seeing progress, there are countries that are still at the peak of the outbreak and the impact can be seen in the stock market. It is hard to imagine that sectors such as the automotive, flying companies, and also movie producers and operators will recover from the chaos they are in at the moment.

Besides, it is still possible to invest properly and profit in this situation. E-commerce is now on evidence by the imposed quarantine. Since it is not possible to move freely, ordering online is a good way to circumvent the lockdown for both consumers and companies. Shopify, one of the biggest in the area, saw its stock more than double its value in the last six months.

The opportunities to profit keep appearing in these moments and missing one of them may result in a loss that may not be recovered quickly. By using the AI stock market predictions of the I Know First algorithm, it is possible to find these opportunities much earlier, generating more profit or, at least, avoiding losses during the Coronavirus pandemic.

To subscribe today click here.