AMZN Stock Forecast: Raising My Amazon Price Target To $3,550

The AMZN stock forecast article was written by Motek Moyen Research Seeking Alpha’s #1 Writer on Long Ideas and #2 in Technology – Senior Analyst at I Know First.

The AMZN stock forecast article was written by Motek Moyen Research Seeking Alpha’s #1 Writer on Long Ideas and #2 in Technology – Senior Analyst at I Know First.

Summary

- Thanks to my high faith in I Know First, my June 29 prediction that Amazon’s stock will bounce to $3,000 quickly became a reality.

- Amazon’s stock posted a record-setting 52-week high of $3,344.29 last July 13. Massive profit-taking eventually forced the stock $3,100. I’m therefore endorsing AMZN as a buy.

- The inability of Microsoft and Google to dethrone Amazon’s leadership in cloud computing infrastructure is why I’m giving AMZN a new price target of $3,550.

- As per its July 30 ER, Amazon had an amazing Q2. The second-quarter $88.91 revenue is +40% Y/Y. AWS revenue for Q2 was $10.81 billion, +29% Y/Y.

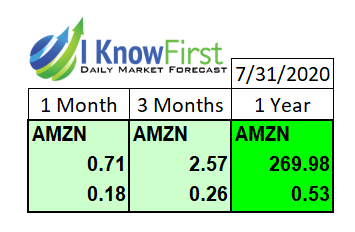

- My endless optimism for Amazon is again thanks to its bullish one-year trend forecast from I Know First.

My success as a high-accuracy equity analyst is thanks to the daily algorithmic forecasts I get from I Know First. The latest and strongest proof of this is my Amazon stock forecast from June 28 with buy recommendation from I Know First. I boldly predicted that AMZN will bounce back to $3,000 when it was trading $2,700. Thanks to the gods of probabilities, AMZN zoomed up to as high as $3,344.29 last July 13. Profit-taking caused AMZN to dip to below $3,100. However, Amazon had a very impressive Q2 ER yesterday.

AMZN traded as high as $3,204 during the after-hours trading, and pre-market trading today saw it hit $3,218.

Thanks to its amazing Q2 numbers, I now have a $3,550 price target for Amazon. I’m sure many retail and institutional investors got inspired by Amazon’s Q2 revenue of $88.91 billion (+40.23 Y/Y and beats by $7.62 billion), and EPS of $10.30. No thanks to COVID-19, that $10.30 Q2 EPS was $8.65 higher than what the Street expected. Amazon said it incurred additional expenses of $4 billion in its anti-COVID 19 measures. In spite of this, Q2’s net income of $5.2 billion was double that of Q2 2019’s net income of $2.6 billion.

The large improvement in quarterly net income and sales would not have been possible if COVID-19 did not come. My takeaway now is that Amazon will probably spend some of that $5.2 billion net income to buy more delivery ships, planes, trucks, and cars for its Amazon Logistics subsidiary.

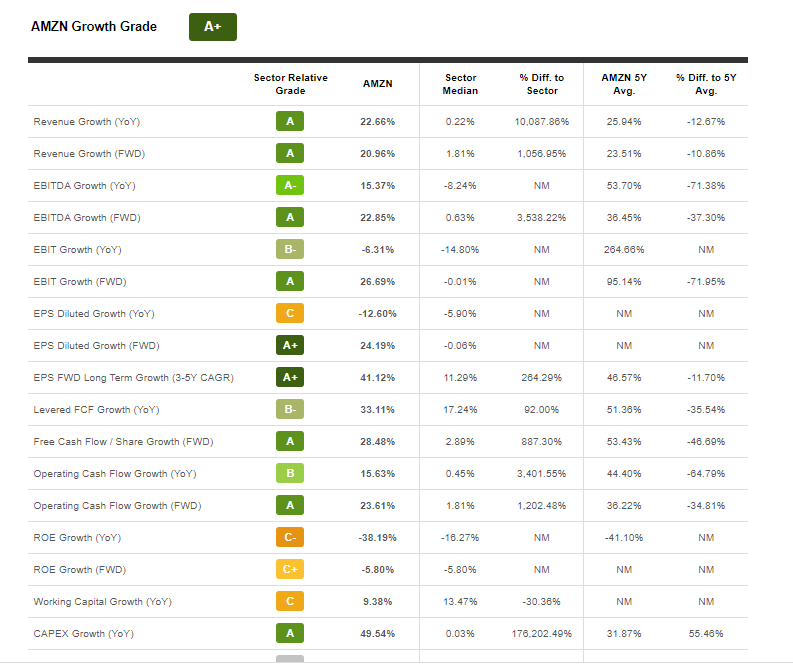

Amazon’s fleet of planes, ships, and trucks needs more investment because the ongoing pandemic will continue to boost the big need for online shopping. The surging adoption of online shopping convinced me that Amazon will maintain its 26% 5-year average revenue CAGR for the next five years. This COVID-19 pandemic is enhancing the already-high growth performance of Amazon. The super high valuation ratios of AMZN is still largely because of its 26% average annual sales growth.

Near-Term Prediction

AMZN could breach $3,300 later today and $3,400 by next week. A big herd of bulls will rally around AMZN starting today because AWS (its cloud computing segment) posted Q2 revenue of $10.81 billion (+29% Y/Y). Bezos called Q2 another unusual quarter. On the other hand, is clear to all of us that Amazon’s e-commerce and cloud computing business segments are getting seriously boosted by the COVID-19 pandemic. Amazon’s e-commerce sales in North America 43% Y/T to $55.44 billion. International online sales revenue grew 38% Y/Y to $22.6 billion. Online shopping became the new normal for people terrified of getting exposed to the COVID-19 antivirus. The pandemic tailwinds will remain strong this second-half of 2020. Many will be buying AMZN shares the next few days. I’m highly confident that AMZN could deliver my 1-year price target of $3,550 even before December 31 comes.

The long-term scenario now is that the COVID-19 pandemic compelled a lot of people to become Amazon Prime member shoppers. The more people that got locked-in or addicted to the discounts and privileges of Amazon Prime membership, the greater chance that they will spend more on Amazon shopping. Amazon Prime members are the big spenders on amazon.com and its international sites. Before the pandemic came around, the average annual purchase of Amazon Prime members was $1,900. Non-Prime members only averaged at $600.

AMZN is a buy because the COVID-19 pandemic is attracting more big-spending Amazon Prime members. The COVID-19 pandemic in America convinced me that the old ‘1 in 3 Americans are subscribed to Amazon Prime’ is now likely 2 in 3 Americas are Prime members.

Bet More On Amazon’s Ambitious Global Satellite Service

You should purchase more AMZN if you plan to hold it for growth/long-term purposes. The international e-commerce sales of Amazon might just become a $40 billion/quarter juggernaut after it is done building its 3,236 Kuiper broadband internet-beaming satellites in space. Kuiper has already been approved by the FCC. Amazon plans to spend more than $10 billion to put up its global Kuiper broadband internet platform.

Going forward, Amazon will probably offer free Kuiper broadband internet in developing countries. This is of course if they sign-up for Amazon Prime membership. Amazon Prime costs $119/year in America and other development markets. However, Amazon could offer a $49/year Amazon Prime for developing regions like India, Southeast Asia, Latin America, and Africa.

Spending $10 billion to provide free (or very cheap) satellite broadband internet is commendable because it would lead to a stronger e-commerce growth for Amazon. AWS instances will also be available for rent/access to remote places that domestic internet companies cannot service through DSL, cable, fiber internet, or 5G services.

Conclusion

No thanks to COVID-19, Amazon will likely wrap up its fiscal year 2020 with $365 billion in revenue, and EPS of $23. 5Using its current forward TTM GAAP P/E valuation of 156.24, we can just multiply $23 by 156.24 to get a future price estimate of $3,593.52 for AMZN. Getting to full year EPS of $23 is easy because AMZN already reported a Q2 EPS of $10.30. The Q1 2020 EPS was $5.01. The relentless pandemic tailwind will easily help Amazon deliver Q3 and Q4 EPS figures that when combined, would produce $8 or higher.

My reiterated buy rating for AMZN is also thanks to its very bullish one-year trend score from I Know First. A stock only needs to score 100 but AMZN got a 1-year trend score of $269.98 from the predictive AI of I Know First.

Past I Know First AMZN Stock Forecast Success

I Know First was successful with AMZN stock forecast. On June 28 2020, the I Know First algorithm issued a bullish AMZN stock forecast and the algorithm successfully forecasted the movement of the AMZN stock. In one month, AMZN shares rose by 12.65% in line with the I Know First algorithm’s forecast. See chart below.

I Know First’s algorithmic trading AI have modeled and generated market movements for 6 time horizons. We provide stock picking strategies for institutional clients, as well as private investors to identify the best investment opportunities in the market. We have various packages of stock market forecast, such as aggressive stocks, top tech stocks as well as Euro to dollar forecast, and Apple stock news that you can find at apple-stock-news.com. Today, we also provide gold predictions and commodity price prediction.

To subscribe today click here.

Please note-for trading decisions use the most recent forecast