QCOM Stock Forecast: Leadership in 5G Processors Makes Qualcomm A Buy

The QCOM Stock Forecast article was written by Motek Moyen Research Seeking Alpha’s #1 Writer on Long Ideas and #2 in Technology – Senior Analyst at I Know First.

The QCOM Stock Forecast article was written by Motek Moyen Research Seeking Alpha’s #1 Writer on Long Ideas and #2 in Technology – Senior Analyst at I Know First.

Summary

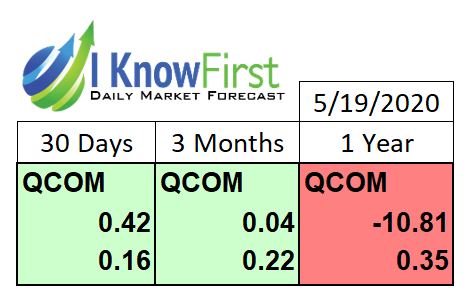

- The predictive algorithm of I Know First has a neutral tone forecast for QCOM stock. This is in spite of the stock’s big 5.5% gain on May 18.

- Yes, Qualcomm is vulnerable if China decides to retaliate against new U.S. sanctions versus Huawei. However, Foxconn now has factories outside China.

- Chinese mobile device vendors still rely on Qualcomm processors. Qualcomm is still the world’s top supplier of smartphone processors.

- Strategy Analytics also reported that Qualcomm took a 52% market share in 5G baseband processors in 2019. This will continue for many years to come.

- Monthly technical indicators are saying QCOM is a strong buy right now. The stock could rebound to above $90 before 2020 ends.

I remain long on Qualcomm (QCOM) and I am endorsing it as a decent buy. My optimism over Qualcomm’s future is me looking beyond the COVID-19 headwind. Yes, the 5G revolution has been delayed by this pandemic. On the other hand, the world is capable of adjusting to life with COVID-19 infections. What is more important is that COVID-19 quarantines are forcing people and companies to appreciate the higher internet speed of 5G-enabled devices. Work-from-home and learn-from-home require people to have the optimal internet speed to maximize their productivity.

Qualcomm’s industry-leading 36% market share in smartphone processors will continue this year. Like it or not, the dominance of Snapdragon processors will boost QCOM’s price to above $90 again before 2020 ends.

My buy recommendation for QCOM stock is contrary to the neutral algorithmic forecast of I Know First. The lack of enthusiasm from I Know First’s predictive AI is in spite of the big one-day 5.5% increase in QCOM’s price yesterday, May 18. The AI of I Know First is likely wary of China’s warning that it will retaliate against America’s new sanctions against Huawei.

China is the biggest contributor to Qualcomm’s annual sales. China is where most mobile devices and computers are assembled/manufactured. Pres. Trump’s trade war with China is largely why Qualcomm’s China revenue in 2019 dropped to just $11.61 billion. This was a notable drop from 2019’s revenue of $15.15 billion. China’s revenge move against Trump’s anti-Huawei sanctions last year was to encourage Chinese factories to use non-U.S. made semiconductor parts for electronic products assembled in that country.

Ignore The FUD Noise, Qualcomm Can Still Supply To Huawei

Go long on QCOM. Just ignore the fear, uncertainty, and doubt (FUD) that Trump’s latest anti-China has created. The new sanctions from the U.S. Department of Commerce only require U.S. companies to apply for a license first before they can supply software and hardware technologies to Huawei. I’m sure Qualcomm can get a license so it can keep supplying its 4G and 5G-enabled processors to Huawei.

The big picture is that Qualcomm only makes proprietary designs of mobile application processors. These designs are based on ARM Holdings’ ARM processor architecture. Qualcomm’s Snapdragon processors are made outside the United States. The core intellectual property covering Snapdragon mobile application processors is not owned by Qualcomm. It only has a license to design and sell ARM-based processors. Qualcomm is therefore likely safe from China’s new retaliatory measures.

The intellectual property covering ARM-based processors are not owned by American companies. ARM Holdings is a British company that is now owned by Japanese firm SoftBank. The United Kingdom is not a pet of Trump. It is still allowing Huawei to help build the 5G infrastructure of the United Kingdom. Japan will never require Qualcomm to get a license so it can supply its processors to Huawei. The point is that in spite of the new sanctions, Huawei will still be able to procure semiconductor parts/products from other countries that are not cowed by Trump’s warmongering against Huawei. Trump is wrong to accuse Huawei of copying U.S. processor designs. Huawei also has a license from ARM Holdings.

My buy endorsement for QCOM is also due to WalletInvestor’s slightly bullish one-year forecast for it. WalletInvestor is confident that QCOM deserves a one-year price target of $84.955 and a 5-year price target of $122.416. I cross-referenced WalletInvestor’s emotion by checking QCOM’s technical indicators. The monthly technical indicators chart below also endorses QCOM as a strong buy.

Betting on QCOM now is safe. Based on MacroAxis’ algorithm Qualcomm’s stock has an Altman Z score of 12.1. Altman Z is a simple fundamental metric to gauge how likely a company is to fail or go bankrupt. The higher the Z score, the lesser chance there is for a company to go bankrupt.

Make An Affordable Bet On The No. 1 In Smartphone Processors

You should go long on QCOM. This stock is not yet overpriced. Compared to its technology/semiconductor sector peers, Qualcomm’s stock has notably lower valuation ratios. QCOM has a far better balance sheet and profitability than Advanced Micro Devices (AMD). Exploit the current undervaluation of QCOM against AMD. Qualcomm will always have a future than AMD. Buying QCOM shares now is like making an affordable bet that could return big winnings.

The best thing to do now is to cash out your profits on Nvidia (NVDA) and AMD. Use those profits to buy more QCOM.

Qualcomm is still the no. 1 seller of mobile application processors. The long-term prosperity of this company is assured because Huawei/HiSilicon, MediaTek, Rockchip, Allwinner, and other Chinese ARM-license holders still cannot beat Qualcomm’s Snapdragon processors.

Moreover, Strategy Analytics also reported that Qualcomm took a 41% market share of the $20.9 billion global cellular baseband processors market. Qualcomm’s industry-leading x50 5G modem is also why it reaped 53% unit share in 5G cellular baseband modems in 2019.

Huawei’s HiSilicon subsidiary, Samsung (SSNLF), and MediaTek are still in the shadow of Qualcomm when it comes to ARM processors’ performance. The best performing Android phones tested by Antutu are all equipped with Qualcomm’s flagship Snapdragon 865 5G SoC. The chart below is a loud endorsement that we should all buy more shares of QCOM. Chinese and Korean mobile device vendors will continue to patronize Snapdragon processors for many years to come.

Conclusion

QCOM is a strong buy. We learned to survive and prosper with no vaccines for HIV, seasonal influenza, and the common cold. Life will go on even if there’s no vaccine or universal cure for COVID-19 infections. Qualcomm will still grow and prosper with its industry-leading smartphone processors and 5G cellular modems. Smartphone vendors will prioritize selling 5G enabled devices starting this year. Pandemic quarantines are forcing more people to acquire gadgets with the fastest internet connectivity.

Buy QCOM also because of its decent dividend payments. As per Seeking Alpha’s chart below, QCOM’s forward dividend yield is 3.25%. It is always great to invest in a company that consistently shares the annual profit to its shareholders.

Lastly, Qualcomm has a solid balance sheet. Qualcomm’s cash reserve is almost $10 billion. Qualcomm has always posted positive annual free cash flow. Qualcomm is a very safe long-term investment because it can endure the temporary headwinds of any pandemic. The MacroAxis told me that Qualcomm has less than a 1% chance of going bankrupt.

Past I Know First Success with QCOM

I Know First has been bullish on the QCOM stock price forecast in past predictions. The I Know First algorithm issued a bullish outlook on April 17, 2019. The algorithm forecast successfully predicted the movement of the QCOM stock price and rose by 34.40% after one year. See the chart below.

Here at I Know First, our AI-based quantitative trading algorithm has modeled and predicted assets price movement worldwide for short-term and long-term time horizons, ranging from 3 days to a year. Since 2011, we have been providing stock market predictions, as well as forex forecasts, and a gold price forecast. Also, we have a specially dedicated portal to Apple, the apple-stock-news.com. Today, we are producing daily forecasts for over 10,500 assets. These forecasts generated by our algorithmic trading tool are used by institutional clients, as well as private investors and traders to identify the best investment opportunities in the market.

To subscribe today click here.

Please note-for trading decisions use the most recent forecast.