Aggressive Stocks Predictions: Real-life Success Story Amid Market Chaos

Summary:

- Market volatility and chaos pushes investors to either take greater risks or go into safe assets zone in 2020

- Aggressive stocks outstand from the market providing higher returns far above the S&P 500

- AI-powered stock predictive algorithm enabled I Know First client to create aggressive stocks portfolios to outperform market 7 times within 3 months

How Risky is the Stock Market Nowadays?

Have you ever imagined 2020 to be that risky and aggressive stocks strategies to become popular more than ever before? Looking back to January 2020, many market players now are not feeling well about diversification or following the Wall street gurus’ strategies, like Warren Buffet, who invested for the long term into ‘real’ economy sectors. While the whole world was going into closures and various economy sectors were seizing operations as the global pandemic was gaining momentum in March, we at I Know First we perfecting our AI predictive algorithm to identify the Coronavirus stock market opportunities for our investors who were trying to understand what are their options for next moves.

On one hand, we could see classic crisis response when many investors shifted towards safe assets, like gold and other precious metals, while liquidating positions in companies that were previously considered as stable cash-flow generators like airlines and car manufacturers. On the other hand, we could see a unique situation when flocks of new and young Robinhood investors exploited the falling stock prices to “buy low” and contributed to the market volatility even more. In between those groups, many professional and retail investors were still unsure whether to go safe or ride on the market waves – they were forced to be more creative with their portfolios and go for the economic sectors that are connected to high-tech, medicine, and online retail. However, the prospects of those sectors were affected by many factors that needed to be accounted such as demand for services spike and the companies’ capability to address it.

Another stock class that was not new to the volatility while being recognized as ones providing higher than average returns was the aggressive stocks sector. An aggressive stock is a higher-risk investment that can potentially produce higher returns than more conservative stocks, but also has equal potential for bigger losses. Examples of aggressive stocks would include junior mining stocks, smaller technology stocks, and penny stocks. Therefore, these stocks that already were considered risky assets became not that aggressive within the new market realm.

AI Aggressive Stocks Predictions – Is It Possible to Leverage on Higher Risk?

As a general rule, an average non-conservative investor tries to limit aggressive stocks share within the portfolio to approximately 30% of the overall portfolio. At the same time, conservative investors could take up no more than 10% of a portfolio. An aggressive stock is often more highly leveraged (with more debt) and volatile than value or conservative stocks. That doesn’t mean one should avoid aggressive stock investing altogether. Even for conservative investors, there are very good reasons to add some aggressive stocks—in limited quantities—to their portfolios. In fact, if you choose the right aggressive stocks, they can offer the opportunity to earn bigger returns without exposing you to excessive risk. The next question is how to choose the right stocks and is it manageable for an ordinary investor?

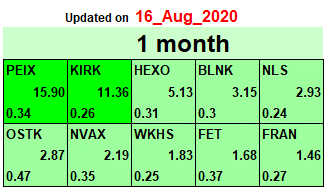

One of I Know First clients decided to share his experience with the public about him elaborating on AI-driven predictions exclusively and following them until now. The approach was to take 1-month forecasts from the Aggressive stocks package and invest in the top 5 and 10 stocks indicated in the heatmap in separate portfolios. This experiment started on August 16, 2020, and the weights of the stocks in the portfolio were equal during the whole experiment – in other words, the strategy was buy-and-hold.

At this time the S&P 500 index was heading towards its one of the highest peaks since 1986. However, the degree of uncertainty towards September and October was increasing as the US election campaign hit its hottest phase – debates. Besides, the stock market started to receive negative signals about the future prospect of vaccine development from Moderna and Johnson & Johnson that contributed to prolonged expectations on economic recovery. Within this context, the above ten companies comprised a portfolio of companies from Energy (PEIX, FET), Consumer (KIRK, BLNK, NLS, OSTK, WKHS, FRAN), and Healthcare (HEXO, NVAX).

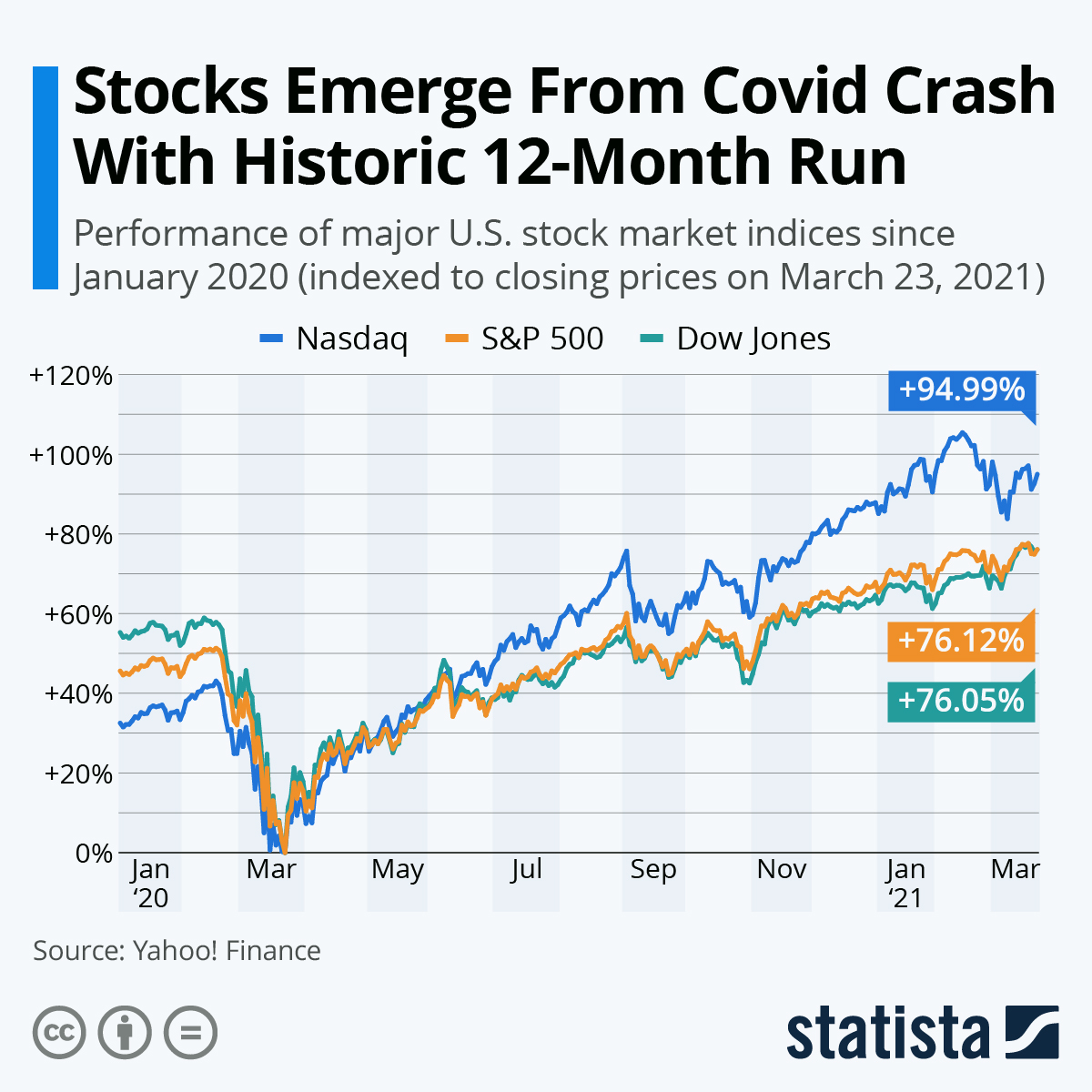

As we see from the above, the market response was quite rapid – both the S&P 500 and NASDAQ 100 indexes were falling significantly. Up so far, the market shows recovery despite the remaining market uncertainty in the USA. As for the portfolio of our client, the investments into the above ten companies started to pay off almost immediately and as of the August 19th the return schedule is as follows:

| Top 5 Aggressive Stocks | Open Price – Aug 16 | Last Price – Oct 19 | Return |

|---|---|---|---|

| PIEX | $3.42 | $10.83 | 216.67% |

| KIRK | $7.65 | $11.51 | 50.46% |

| HEXO | $0.79 | $0.78 | -1.27% |

| BLNK | $11.06 | $9.22 | -16.64% |

| NLS | $13.74 | $24.11 | 75.47% |

| Portfolio Return | 64.94% |

| Top 10 Aggressive Stocks | Open Price – Aug 16 | Last Price – Oct 19 | Return |

|---|---|---|---|

| PIEX | $3.42 | $10.83 | 216.67% |

| KIRK | $7.65 | $11.51 | 50.46% |

| HEXO | $0.79 | $0.78 | -1.28% |

| BLNK | $11.06 | $9.22 | -16.64% |

| NLS | $13.74 | $24.11 | 75.47% |

| OSTK | $93.36 | $72.65 | -22.18% |

| NVAX | $146.51 | $102.05 | -30.35% |

| WKHS | $15.27 | $22.23 | 45.58% |

| FET | $0.51 | $0.56 | 9.80% |

| FRAN | $5.37 | $3 | -44.13% |

| Portfolio Return | 28.34% |

Conclusion

This case study highlighted a few key facts. First, the relative aggressiveness of stocks during volatile and less predictable times, as usual, provides significant market opportunities for a number of economic sectors – Energy, Consumer, and Healthcare. Second, the stock predictions produced by AI are capable of providing enough reliability to leverage the risk associated with such stocks and gain profits even amid the global pandemic. Finally, the signal and predictability indicators by which the Aggressive stocks package ranks the stock picks allows investors to rely solely on the stock ranking provided by I Know First to keep the portfolio with an appropriate diversified structure.

To subscribe today click here.

Please note-for trading decisions use the most recent forecast.