Winning Stock Forecast – BLNK and BEEM: up to 108.26% in 1 Month

Winning stock forecast BLNK: Increase 93.08% Following 1 Month Forecast

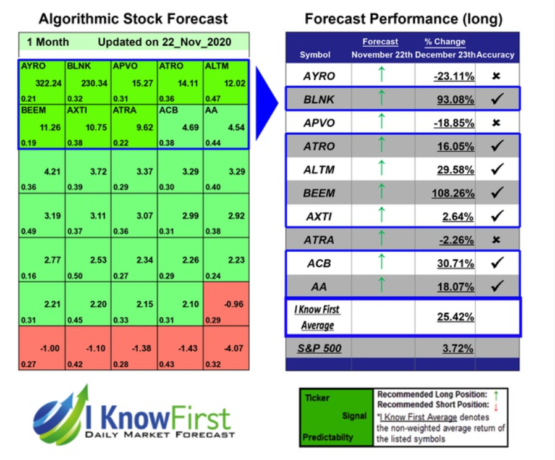

On December 23, I Know First issued a 1-month winning stock forecast for BLNK with a strong bullish signal of 230.34 and the predictability of 0.32. 1 month later, BLNK stock rose from $33.62 to $43.78. This 93.08% surge was in line with our forecast.

Blink Charging Co owns, operates, and provides electric vehicle (EV) charging equipment and networked EV charging services in the United States. According to www.fool.com , at the end of the third quarter, Blink Charging owned or operated 15,716 charging stations, up from 14,778 as of the end of 2019. The company’s revenue in the first nine months of 2020 rose 84% year-over-year.

Although Blink holds less than 10% of North America’s market, the company has patented cloud-based EV charging station software. The company also strives for clean energy. The long-term agreement with Lehigh Valley Health Network was the key factor behind the companies’ shares’ growth. The company will install a total of 219 car chargers in 35-inch hospitals, medical centers, doctors’ offices.

It is worth noting that the electric vehicle market has a positive outlook in the long term. With global EV purchases forecast to grow to 10 million by 2025 from roughly 2 million in 2019. The Company has established key strategic partnerships to roll out the implementation in many locations, including parking lots, apartment buildings and condos, workplaces, healthcare facilities, etc.

Of particular interest to investors in Blink may be the $ 1.1 billion for electric batteries and $ 2.4 billion for grid upgrades (in funds for electric vehicle charging networks).

BEAM Increased by 108.26% in 1 Month

In the same winning stock forecast, I Know First also presented a bullish 1-month stock forecast for BEEM. The forecast showed a signal of 11.26. Predictability of 0.19, following which BEEM stock achieved a 108,26% increase from $35.19 to $52.69.

The key factor behind the stock’s growth was the grant of a patent for an autonomous renewable charger for the UAV ARC unmanned aerial vehicle. Both commercial and military customers must accept Beam. As drones play an increasingly important role in parcel delivery and situational awareness. Business Insider Intelligence predicts that global drone shipments will reach 2.4 million units in 2023, increasing with an average annual growth rate of 66%.

Also, the key point in the growth of shares in the public offering of shares. The current working capital of approximately $ 14.0 million is sufficient for several years of operation. The next key point: The company has deployed the first 8 of 30 stand-alone solar EV ARC ™ terminals for Electrify America. The company plans to commission the remaining 22 units in the fourth quarter of 2020. The third key: The EV ARC ™ product, was based on the world’s first Flying on Sunshine ™ test flight on a Pipistrel electric aircraft. The successful test flight confirmed the technology and was the first step in a larger program the company intends to implement in 2021.

Please note-for trading decisions use the most recent forecast. Get today’s forecast for Volatility Indexes and Top stock picks.