GME Stock Forecast: Stock to Continue to Rise Even After 137% Surge

This GME stock forecast article was written by Maria Grishaev, Analyst at I Know First.

This GME stock forecast article was written by Maria Grishaev, Analyst at I Know First.

Executive Summary

- Following the announcement of the partnership with Microsoft, GameStop Corp received a boost in stock price.

- Quantitative analysis results indicate bullish signals after stock price topped out the moving average line.

- GME deserves a one-year target price of 22$, representing revenue growth.

Overview

Earlier this month, GameStop Corp. (NYSE: GME) announced that it has entered into a multi-year strategic partnership agreement with Microsoft Corp and the stock price surged by 18% shortly after. GameStop will be using Microsoft’s back-end solutions to better meet customer needs in the digital gaming era and both companies will benefit from the customer acquisition and lifetime revenue value of each gamer brought into the Xbox ecosystem.

Also, two filings with the US SEC revealed that RC Ventures LLC, managed by Ryan Cohen, and Senvest Management, a New-York based fund, increased their ownership stake in the company to 9.98% and 5.54% respectively. RC Ventures LLC purchased its first group of 5.8M shares in late August.

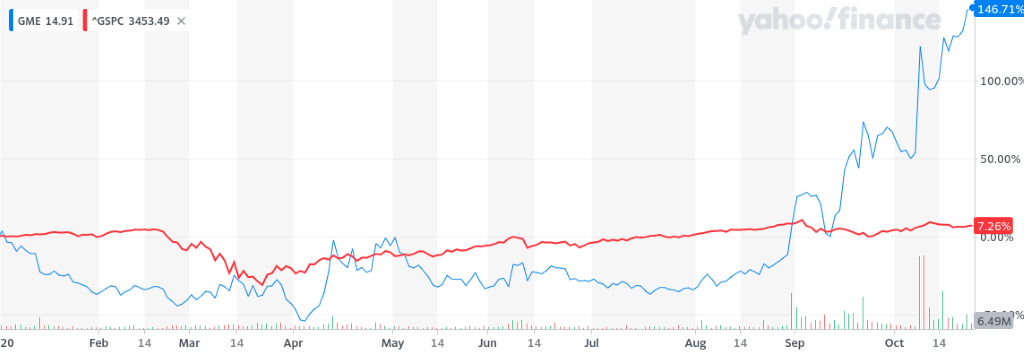

These events helped the stock price to surge in total by 146.71% YTD in comparison to a 7.26% rise of the S&P500.

GME Improving Above the Industry Average

In order to better understand the performance of the company, let’s compare the performance of GME to the technology retail sector before and during COVID-19 time.

Within the technology retail industry, only one company achieved a higher Quick Ratio in the second quarter of 2020 and 3 other companies have achieved lower Total Debt to Equity than GME. While the price-to-sales ratio went down by a small margin on average in the industry, GME had its ratio rise significantly from 0.06 to 0.17. We can also see from the table that in most ratios GME has performed better than the industry average.

The financial results for the second quarter of 2020 reflected strong positive cash flow, a strengthened balance sheet, and progress toward its strategic objectives despite the negative impact of temporary store closures related to COVID-19. They saw an 800% increase in global E-commerce sales (that represent over 20% of total net sales), a $133.7 million reduction in SG&A, and a significant improvement in the balance sheet with $735.1 million in cash and a 50% reduction in inventory. In addition, GameStop issued new notes earlier this summer to provide additional financial flexibility by replacing and extending the maturity of existing notes to 2023. This move shows that the issuers of the notes believe in the company’s ability to pay back its debt.

Indicators Show a BUY Signal and Further Trading Opportunities

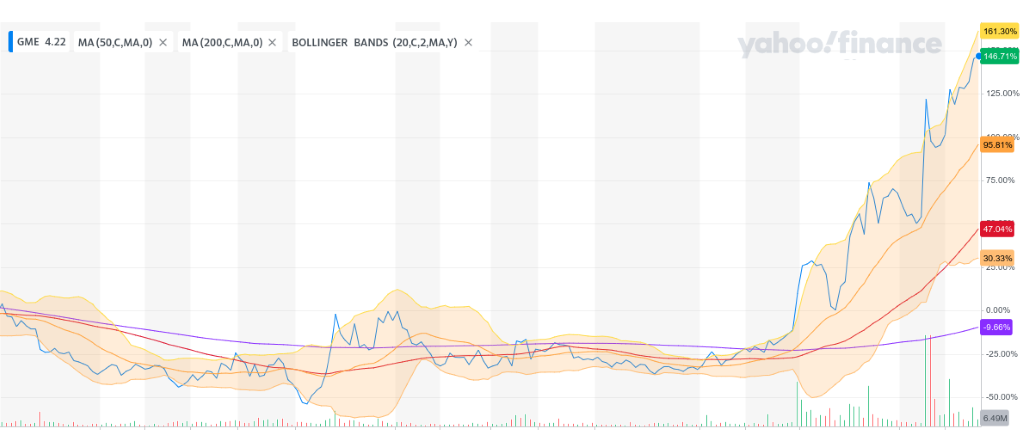

As we can see in the chart, the most recent time that the stock price crossed above the moving average for 200 days (the purple line) was in August and it signaled a potential change in trend. That was indeed the case as the stock started its rise there. We can also see that the moving average for 50 days (the red line) crosses above the moving average for 200 days and it also indicates that the trend is shifting up. This is the known “golden cross” that gives us a buy signal.

The Bollinger Bands® technique also indicated a potential opportunity. When the bands come close together it is called a squeeze. A squeeze signals a period of low volatility and is considered by traders to be a potential sign of future increased volatility and possible trading opportunities. This can be seen happening here from June to August. The peaks outside the bands correspond with the SEC filing discussed above and the Microsoft partnership announcement.

The Yahoo Finance coverage for the company is performed by 12 analysts, with the majority of whom took the hold position on the GME stock. The analysts’ community puts the average target price for GME stock at 6.96$ while it is still gaining momentum at 15$ which makes a 115% difference.

To explain this difference, I estimated my own target GME stock price by using the Multiples Valuation method. Based on this data, the average Price to Book ratio in the technology retail industry is 2.09. The current annual book value per share ratio for GME is 9.51. Recall that the book value per share is calculated by the difference between the total assets and total liabilities of the company divided by the total number of shares. The assumptions taken in this calculation are that the total assets will grow by 5% in light of the announced partnership and expense reduction initiatives and that the liabilities will be reduced by 3%. As the number of shares was reduced from 88M to 65.17M this year, I don’t believe this number to change in the next year. This brings us to a book value per share of 10.41 and a price target of around 22$. This makes it a higher price target than the current analysts’ predictions.

Conclusion

I take the buy-side on GME stock because I see the potential for the company’s growth comparing to its peers in the retail market. It is reasonable to expect further growth of GME stock price as they utilize their new partnership with Microsoft along with their plan to continue to improve their balance sheet and prioritizing the allocation of resources to areas of the business that produce strong cash flow.

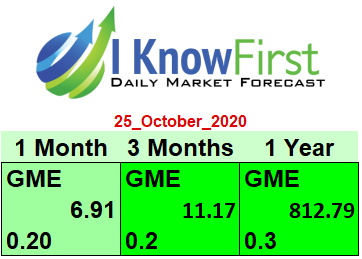

Please note that the stock-picking AI of I Know First has a high signal on the one-year market trend forecasts. The light green for the one month forecast is mildly bullish while the darker green is a strong bullish signal for the 3-months and one-year forecast.

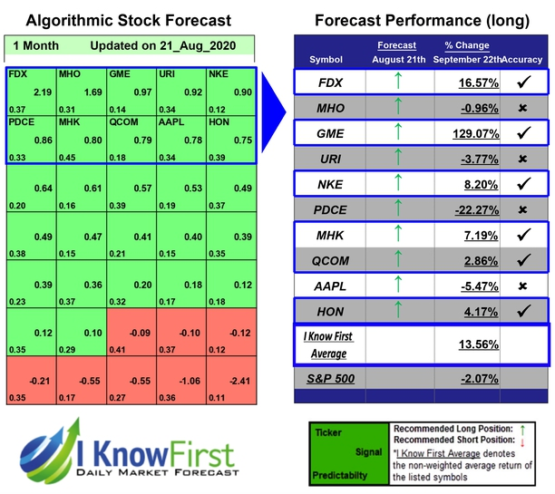

Past Success with GME Stock Forecast

I Know First noticed the upward trend of GME and has been bullish with the price since early August until now. On August 21, 2020, the I Know First algorithm recommended GME as one of the best hedge fund stocks package picks to buy. The AI-driven GME stock forecast was successful on a one-month horizon resulting in a 129.07% gain since the forecast date.

Moreover, on October 20, 2019, the I Know First algorithm also recommended GME as one of the best hedge fund stocks package picks to buy. The AI-driven GME stock forecast was successful on a one-year horizon resulting in a 137.37% gain since the forecast date.

To subscribe today click here.

Please note – for trading decisions use the most recent forecast.