Crypto and Blockchain: The Next Step in the Evolution of Money

This Crypto and Blockchain article was written by Sergey Okun – Financial Analyst, I Know First.

Highlights:

- Since January 2021, Ethereum’s price has grown by 233% – currently, there is a high-grade correction that allows determining points for position opening

- COVID-19 has created a good environment for cryptocurrency development

- Ethereum is not just another cryptocurrency, but it has already become a unique financial asset that possesses different economic implementations

- Ethereum provides high potential for portfolio diversification

Where Is the Intrinsic Value of the Cryptocurrency?

Money is the most important and mysterious thing in the economy. Everyone has it and uses it in everyday life as an instrument of exchange. Most people spend a significant part of their life earning it and accumulating it for retirement or bequest it for their children so that they have a better life. Money has been with people all the time in human history, and the need for it appeared when people started to exchange things. Money is the lubricant that greases the economic mechanism. The requirement for money depends on the economic environment – the more complex the economic system becomes the higher the requirements for money.

The first time, anything could play the role of money such as cowrie shells or beads, since then, depending on a historical stage people started using precious metals, paper, and electronic money. There are two main features that a mean has to match to be recognized as money: an agreement between people, where it is determined what they use as an instrument of exchange, and trust that this instrument will have exchange power in the future.

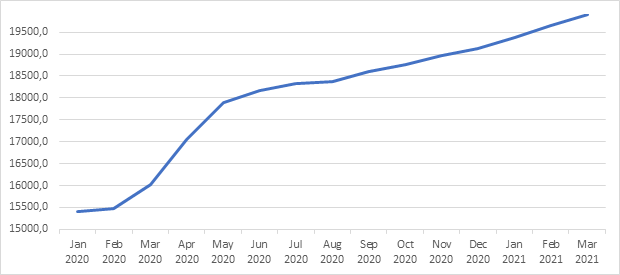

The current technological stage of economic development and integration is to erase boundaries between countries, and the world economy has a requirement for an asset that can be safely used as an instrument of payment and investment and may be independent of political decisions which have agitational characters and may disturb the functioning of the economic mechanism. COVID-19 has had a positive impact on the development of cryptocurrency. Firstly, it has accelerated technology inflections into everyday life such as remote work that erases the distance between an employee and the place of work. Secondly, the development of online retailing requires efficient and secure ways of payment. Thirdly, the supply of money has been dramatically increasing in the pandemic time to support the economy that generates fear of future inflation, and generates demand for secure assets. According to the Federal Reserve Bank of St. Louis money aggregator M2 increased by 25% from March 2020 to March 2021.

(Figure 1 – The Dynamics of M2 Money Stock)

I suppose that investors have begun determining cryptocurrency as a safe haven for the pandemic time. Cryptocurrency is an attractive asset for the time of economic uncertainty for the reason that it is decentralized. Cryptocurrency is a new and hard financial asset to evaluate and I suppose the current cryptocurrency evaluations are similar to the technology stocks’ that lead to the “dot-com bubble” in 2000. Today an investor has a dilemma: on one hand, there are a lot of different cryptocurrencies which are most probably overvalued, while on the other hand, a cryptocurrency can be an attractive investment opportunity with high potential income.

What is Ethereum’s Place in the Cryptocurrency Market?

Ethereum is an important blockchain, being the first and most popular public platform for the smart contracts underpinning financial transactions, time-stamping of supply chains, decentralized applications, and initial coin offerings. There are three types of applications that are based on Ethereum. First, a financial application – provides users with more efficient ways of managing their money. This includes sub-currencies, financial derivatives, hedging contracts, savings wallets, wills, and ultimately even some classes of full-scale employment contracts. The second category is semi-financial applications, where money is involved but there is also a heavy non-monetary side to what is being done. For instance, it is self-enforcing bounties for solutions to computational problems. Finally, there are applications such as online voting and decentralized governance that are not financial at all.

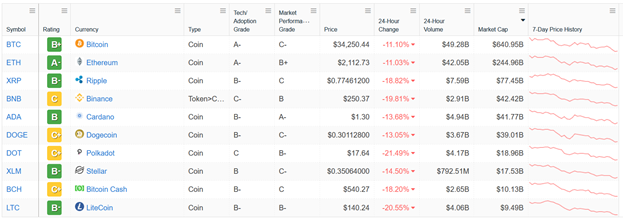

Ethereum is actively traded on centralized exchanges, second only to Bitcoin. Ethereum’s crypto rating is A-, which is the highest current rating across other coins. For instance, Bitcoin has a rating of B+.

We can also measure Ethereum’s uniqueness using an econometric model. I have calculated an econometric model for the dependence of Ethereum on the index CCI30 using monthly data from May 2020 to April 2021 (12 months). The model shows a statistical significance of 0.003 (p-value). The coefficient of determination (R2) is 0.59, which means that the price dynamic of Ethereum depends on the cryptocurrency market price dynamic of 59%, and consequently, 41% of the time the Ethereum price dynamic depends on factors that are characteristic of Ethereum as a unique financial asset. 41% is a high grade of independence which, taking into account Ethereum market capitalization, allows concluding that Ethereum is not just another cryptocurrency, but it has already become a unique financial asset that possesses different economic implementations.

| Coefficient of Correlation | 0.77 |

| Coefficient of Determination | 0.59 |

| Coefficient of Beta | 0.94 |

| P-Value | 0.003 |

(Figure 2 – The Econometric Model Output)

Ethereum has value as a financial asset for portfolio diversification. Traditionally Ethereum had a high correlation with Bitcoin until February 2021, but today Ethereum has the highest correlation with the S&P 500. I suppose the correlation with the S&P 500 will decrease in the future and it could get to the pre-pandemic level.

(Figure 3 – Correlation with a 12-monthly frame)

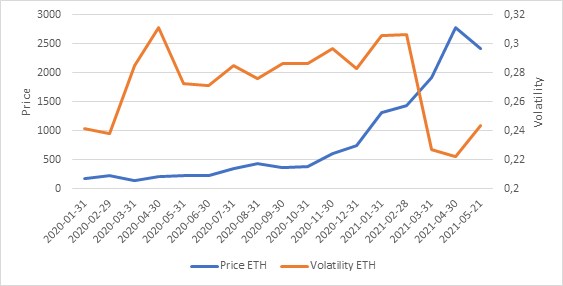

COVID-19 created a «volatility puzzle»,i.e. a situation when a cryptocurrency’s price increases with volatility rise. Such strange price/volatility dynamics for the period between May 2020 and February 2021 may be explained by investors considering cryptocurrencies to be overvalued, though providing a promising investment momentum. Negative volatility dynamics from March 2021 to April 2021 are confirmed by the fact that a significant decrease in volatility preceded the following significant price decrease as more risk-averse investors left the market. The current volatility increases in May 2021 correlating with a negative price dynamic. In my opinion, the current price correction creates two investment advantages:

- Opportunity to open position with a lower price and, as consequence, having a lower risk

- The absence of the «volatility puzzle» in the future will have a positive effect in the long-term due to investors not looking to rapidly closing their positions potentially making the market more predictable and riskless

(Figure 4 – Dynamics of Ethereum Price and Monthly Volatility)

Where is the Most Appropriate Entry Point?

As we can see in the chart, currently Ethereum’s price is on the downtrend and it is lower than its two moving averages (the green line is MA-50; the yellow line is MA-100). I suppose that the price can fall to $1977 or even to $1408 that can be considered as good points for position opening.

Conclusion

I take a buy-side on Ethereum. A cryptocurrency has tremendous prospects for development and growth that are due to the economic environment and requirements for the next-gen money. Ethereum is already perceived as a unique cryptocurrency that has diverse applications. Also, Ethereum has value as a financial asset that allows diversifying investment portfolios. Finally, the current price correction forms a unique opportunity to open a position at a lower price with lower risk than before.

It is worth paying attention that the stock-picking AI of I Know First has a high signal on the one-year market trend forecasts, supporting my position for the Ethereum price forecast. The strong green reflects strong bullish signals for the horizons from 1 month to a one-year. It is important, that the above forecast is showcased as is and reflects the AI algorithmic predictive signals on 26 May and it is strongly advised that any investment decisions be made using the most updated forecast.

Past Success with Ethereum Forecast

I Know First has been bullish on the Ethereum forecast in the past. On April 13th, 2021 the I Know First algorithm issued a forecast for ETH/USD and recommended Ethereum as one of the best consumer cryptocurrencies to buy. The AI-driven ETH/USD prediction was successful on a 1-months’ time horizon resulting in more than 81.66%.

To subscribe today click here.

Please note-for trading decisions use the most recent forecast.