AUD/USD Forecast: Will the bullish rally continue?

This AUD/USD pair forecast article was written by Sherwin Seah, Analyst at I Know First.

This AUD/USD pair forecast article was written by Sherwin Seah, Analyst at I Know First.

Highlights:

- In the last 12 months, the Australian dollar has generally been appreciating against the United States dollar.

- I am endorsing AUD/USD as a buy at the breakout price of 0.7818. This is because the trend is likely to continue throughout 2021.

- Australia export price index has been increasing since 2020. This is especially due to increased demand for one of their major exports, iron ore.

- Fed expects inflation to stay as high as 2.5% as well as a long recovery period.

- However, we need to take note should the Fed change their accommodative monetary policy.

Fundamental Analysis

AUD/USD is affected by changes in both the Australian dollar and the United States dollar. Hence, to forecast the direction of AUD/USD, we have to explore the changes Australia and United States is facing.

Australia mainly exports iron ore, gold, coal, and copper. Any changes in the demand or price of these commodities can thus affect the price of AUD/USD. Further, Australia and China have close economic ties. Hence, any changes in China’s policy would potentially affect the price of AUD/USD as well. These relationships are especially evident from the changes since March 2020 during the midst of the pandemic. During this period, China’s pandemic-fuelled stimulus has resulted in a strong rebound in industrial production which requires industrial metal. Thus, the demand for iron ore has reached multi-year highs. This has allowed Australia to capitalize on this opportunity as a major iron ore exporter to China. Therefore, Australia’s export price index has been rising which resulted in a strong rally for AUD/USD since mid-2020.

This strong demand from China is likely to continue until late 2021 with the price of iron ore expected to stay above $100. However, we should take note of growing competitors such as South America and Africa. These countries are looking to increase their iron ore output in the coming years.

On the other hand, the inflation rates have been rising for the United States dollar. St. Louis Federal Reserve President James Bullard said on Tuesday (11th May 2021) that inflation could stay as high as 2.5% next year, while Fed Governor Lael Brainard said weak labour data last week shows the recovery has a long way to run. Thus, this high inflation rate could go on for a period that could further weaken the United States dollar. Furthermore, the improving global growth outlook as countries recover from the pandemic could draw investors’ cash out from the United States currency into emerging markets and developing countries. Thus, this could potentially further weaken the United States dollar which allows AUD/USD to rally further.

US Consumer Price Index (CPI) MoM

However, the growing and higher-than-expected CPI numbers could be a cause for concern for a bullish AUD/USD if the United States decides to ease their accommodative monetary policy. We can expect the bull run for AUD/USD to continue if the Fed continuously ignore the growing inflation. This would likely be the case as Federal Reserve Chairman Jerome Powell has expected these inflationary pressures ahead of time. He said that it will not likely be enough to spur the central bank to hike interest rates. This is further supported by Fed Governor Lael Brainard who believes that the United States should remain patient during this transitory surge associated with the reopening as it will help ensure the needed underlying economic momentum to reach their goals and not be restricted by the premature tightening of financial conditions. Thus, it is unlikely that United States would ease their monetary policy, supporting the bull case for AUD/USD.

Technical Analysis

From a technical analysis standpoint, we can see that AUD/USD has been in a very strong uptrend from April 2020 to March 2021 and we are currently in a consolidation period. This consolidation period is likely attributed to the growing fears of an interest rate hike for the United States dollar. However, with the constant talk of allowing inflation to rise without hiking interest rate during this recovery period, we should likely see a breakout of this consolidation zone to the upside for a continuation of the bullish move.

Conclusion

AUD/USD is a strong buy above the 0.7818 level with a 1-year target level of 0.8100. Australia’s continuous strong export numbers fuelled by the high demand for iron ore from China coupled with the inflation of the United States dollar currently makes AUD/USD a strong buy.

The currency-picking AI of I Know First has a high signal on the one-year market trend forecast for AUD/USD. The light green tone in the short time horizons signifies a mild bullish signal, while the darker green in the one-year time horizon signifies a strong bullish signal.

Past Success with AUD/USD Forecast

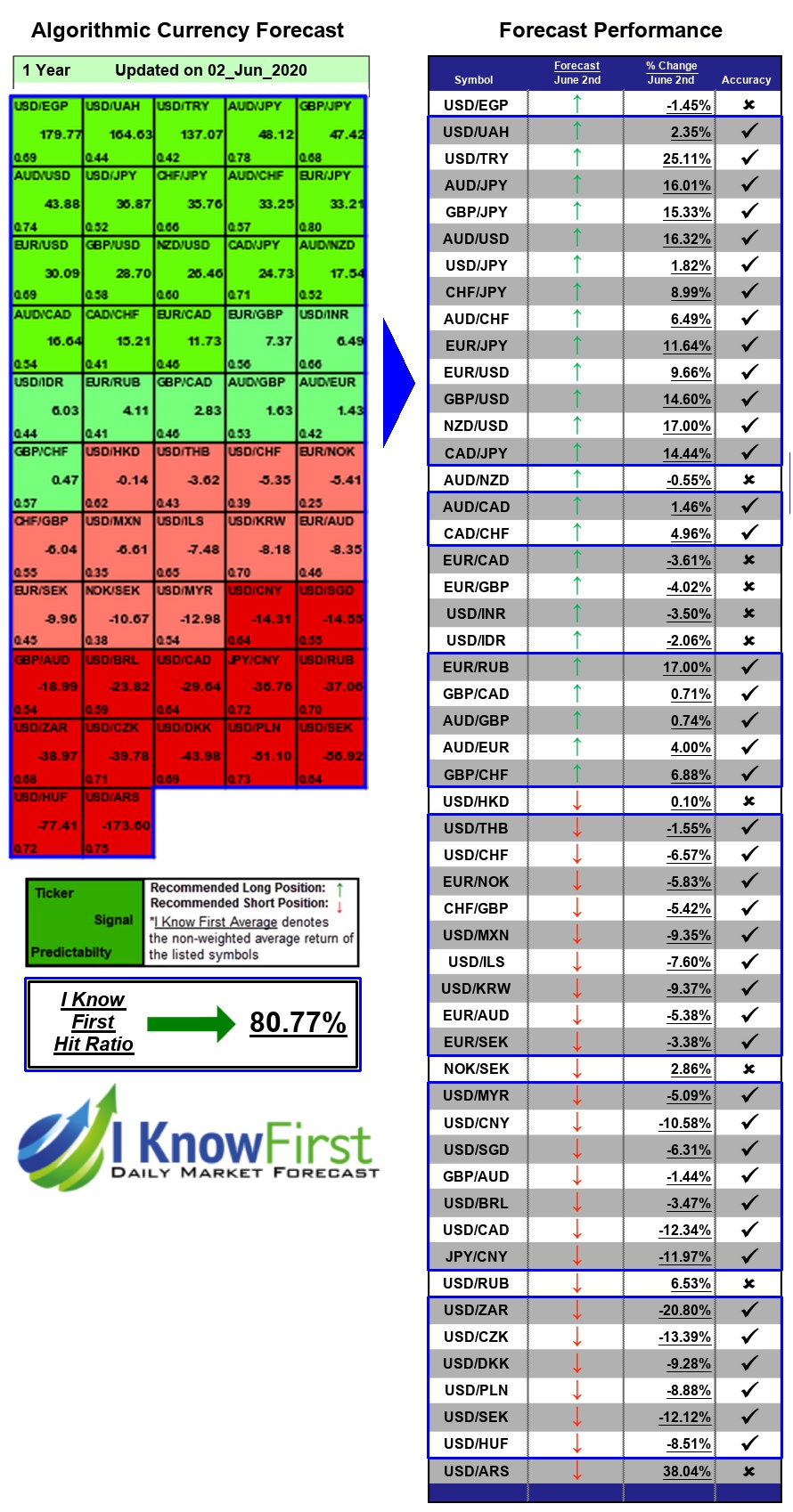

I Know First has been bullish on AUD/USD in the past. On June 2nd, 2020 the I Know First algorithm issued a forecast for AUD/USD and recommended AUD/USD as one of the best currency pairs to trade. The AI-driven AUD/USD prediction was successful on a 1-year time horizon resulting in 16.29%.

To subscribe today click here.

Please note-for trading decisions use the most recent forecast.