MGM Stock Forecast for 2022: Sustaining New Highs

![]() This MGM Stock Forecast for 2022 article was written by Opher Joseph – Financial Analyst, I Know First.

This MGM Stock Forecast for 2022 article was written by Opher Joseph – Financial Analyst, I Know First.

Summary

- Growth in the sports betting digital business is a promising business prospect along with favorable mergers and acquisitions in the pipeline.

- The company is expected to continue land acquisitions for its expansion and growth.

- Online sports betting venture BetMGM is expected to turn in positive returns by 2023 while its customers in the loyalty program have already crossed $36 million.

Overview

MGM Resorts International, through its subsidiaries, owns and operates casino, hotel, and entertainment resorts in the United States and Macau. The company operates through three segments: Las Vegas Strip Resorts, Regional Operations, and MGM China. Its casino resorts offer gaming, hotel, convention, dining, entertainment, retail, and other resort amenities. The company’s casino operations include slots and table games, as well as online sports betting and iGaming through BetMGM. As of February 17, 2021, its portfolio consisted of 29 hotel and destination gaming offerings. The company also owns and operates Las Vegas Strip Resorts and Fallen Oak golf course. Its customers include premium gaming customers; leisure and wholesale travel customers; business travelers; and group customers, including conventions, trade associations, and small meetings. The company was formerly known as MGM MIRAGE and changed its name to MGM Resorts International in June 2010. MGM Resorts International was incorporated in 1986 and is based in Las Vegas, Nevada.

MGM controls close to 50% of the total room capacity in the Las Vegas strip. Some prominent locations include the Bellagio, Park MGM, and MGM Macau. The casino and non-casino segments divide the revenue for the business. The casino business forms over 50% of the income produced in any given year. The revenue generated is relatively uniformly distributed across months. Table games account for 53% of the segment and are the most rapidly growing, averaging close to 12% return any given year. Slot games make up 43% and increase around 11.88% per year. The remaining categories could be classified as other and account for 4%, staying fairly stagnant in revenue. The other business’ revenue is divided between rooms (making up 21%), Food & Beverage (encompassing 17%), and Entertainment and Retail (the remaining 12%). Visitor rates have increased with the economy reopening, boosting the room occupancy levels. (Source: Seeking Alpha).

The MGM Growth Story

The company had a recent management change with the CEO, James Murren, stepping down. The former Chief Marketing Officer William Hornbuckle rose to the challenge in March 2020 and took on the CEO role. He also served as President and COO for various MGM resorts and led efforts to redevelop properties held by the entity. Paul Salem was appointed to the board of directors in March of 2020, holding over 27 years of experience as a Senior Managing Director at the PE firm Providence Equity. The new CFO, Jonathan S. Halkyard, was appointed in June 2021 and led various M&A charges for casino-related industries such as World Series Poker and Horseshoe Gaming. With the management holding over 50 years of collective M&A and redevelopment experience, the company would look to continue land acquisitions for its expansion and growth. (Source: Seeking Alpha)

The company was really hard hit by the rigors of the pandemic and has yet to return to pre-pandemic levels of operations and financial returns. Since the pandemic is still on, the return to normalcy does not feel like coming anytime soon. However, MGM has done most things right during this period, not only to sustain its business but also to deliver positive results on the path to recovery. Given the obstacles of visiting casinos during the pandemic. MGM has largely benefitted from the boom in online players. It looks to drive growth with its BetMGM online business venture, expanding to an increasing number of states in the US, while online betting is legalized in many places and more states are to follow suit, given the rigors of the pandemic. Online sports betting venture BetMGM is expected to turn in positive returns by 2023 while its customers in the loyalty program have already crossed $36 million.

The company earnings report has outperformed analyst predictions since the last four quarters, while almost matching the analyst predictions in the prior quarter. For the upcoming quarter results, it is expected the company will live up to market expectations, however, the current turbulent market conditions make it all the more difficult to predict reliable outcomes. The company stock would face choppy waters in the short run, however, in the long run, its success would largely be driven by expansion of its online businesses, its merger and acquisition strategy in new businesses and properties across the globe.

MGM Has Aggressive Plans For Future Mergers and Acquisitions

MGM has proven itself as one of the most agile companies in the market by successfully following the merger and acquisition strategy, which has brought consistent success to its business. The company has the majority of its business in the US, and gains favorably from its business in Macau. It follows up its strategy with plans to build in international locations including Japan adding new streams of revenue for its business. The sale of MGM’s Mirage Casino to Hard Rock for $ 1.08 billion, allows greater flexibility to MGM in its expansion plans.

The company recently has drawn a lot of market attention with its attempted 100% takeover of Entail. The success of this move would mean a considerable positive outlook for the stock. Also, the macro-economic factors of the pandemic hit the global economy play a deciding role in whether the company can truly wither off its adverse effects and continue its rally during the year.

With available surplus cash, the company has also bought back its own shares to the tune of $1 billion in the first three quarters of 2021 itself, which may supplement the increase in earnings and dividend per share of the existing shareholders. The company has a 3-year average share buyback score of 4.4 which is better than 96% of the 437 companies in the travel & leisure industry. With the company out-performing market expectations for the last four quarters, the company is also expected to increase the dividend per share which was cut down to $0.01 from $0.60.

The company has healthy Operating and Net Margins, with a Return on Equity (ROE) of around 20% and a Return on Assets (ROA) of 3.07 %. Furthermore, MGM’s current P/E GAAP (TTM) ratio of 18.74, and Price/Sales TTM ratio of 2.3 that less than on average across peers.

Conclusion

MGM is certainly seen as one of the mature stocks in the industry and has enough reasons around the positivity of the stock. However, it is faced with many uncertainties and is equally equipped for growth, tipping its balance towards higher valuations. Whether it can sustain to such levels amidst the discovery of new variants of COVID is a question that remains to be answered. However, I feel that there is a good reason to remain positive on this stock while it can easily cross $60 in the coming periods.

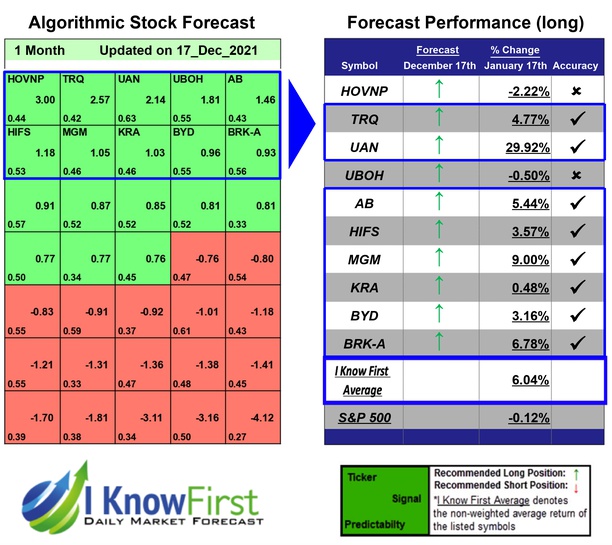

It is worth paying attention that the stock-picking AI of I Know First has a high signal on the one-year market trend forecasts, supporting my position for the MGM stock forecast. The light green for the short-term forecasts is mildly bullish, while the darker green is a strong bullish signal for the one-year forecast.

Past Success with MGM Stock Forecast

I Know First has been bullish on the MGM stock forecast in the past. On December 17th, 2021 the I Know First algorithm issued a forecast for MGM stock price and recommended MGM as one of the best stocks to buy. The AI-driven MGM stock prediction was successful on a 1-month time horizon resulting in more than 9.00%.

To subscribe today click here.

Please note-for trading decisions use the most recent forecast.