AMD Stock Outlook: Inevitable Rebound for AMD

AMD Stock Outlook: Summary

- Divesting from the PC industry and creating inroads into the gaming and GPU markets.

- Shares have hit record lows.

- Potential for takeover in the foreseeable future.

- I Know First is bullish regarding AMD stock.

Advanced Micro Devices (AMD), a global semi-conductor company, has experienced turbulent times recently losing much of its market share to rivals Intel (INTC) amongst challenging times in the PC market. Over the past eleven months Advanced Micro Devices shares have declined from over $4 in August 2014 to its current valuation of less than $2 and Year-to-Date stock performance is -32.58%. Over the past three months in particular, AMD shares were in freefall dropping 28%.

Advanced Micro Devices (AMD), a global semi-conductor company, has experienced turbulent times recently losing much of its market share to rivals Intel (INTC) amongst challenging times in the PC market. Over the past eleven months Advanced Micro Devices shares have declined from over $4 in August 2014 to its current valuation of less than $2 and Year-to-Date stock performance is -32.58%. Over the past three months in particular, AMD shares were in freefall dropping 28%.

Most analysts are naturally sceptical regarding AMD stock. Over the past year, the computer and graphic sector plunged by 54 percent and a sequential decrease of 29 percent and AMD made consecutive losses of $180 million in the past two quarters. The decline in the PC market was the biggest drop in the sectors history and AMD shares have fell correspondingly. However, its current low share price of $1.80 dollars provides me with somewhat optimism for upside movement for AMD.

Divesting from the PC Market

As mentioned above, AMD is currently reeling over flagging PC demand and demand for PCs is forecasted to decrease consistently in the upcoming years ahead.

(Figure 1)

Consequently, AMD have shifted their focus to the gaming market. On June 17th, AMD launched three `next-generation` Radeon graphic processing unit (GPU) chips at the Electronic Entertainment Expo; the Radeon R9 Fury series, the Radeon R9 300 series and the Radeon R7 300 series. Microsoft (MSFT) and Sony (SNE) already utilise AMD’s specifically-designed Jaguar chips for their PlayStation 4 and Xbox One consoles. Likewise, Apple (AAPL) uses AMD’s dual FirePro professional graphics solutions in its highly successful Mac Pros.

Like PC chips, the GPU market is currently dominated by Intel, but by shifting the focus on the gaming industry AMD hopes to gain a larger share of the market.

(Figure 2)

Gaming is fast becoming Advanced Micro Devices key market for growth and plays a big part of their multi-year growth strategy. Deals with tech giants; Apple, Microsoft and Sony, coupled with a high demand for GPUs for in-vehicle infotainment and smartphones in China bode well for AMD’s future growth. Shifting operations from the PC market to the GPU market is perhaps Advanced Micro Chips greatest chance of becoming profitable again.

Incredibly Low Market Price

AMD shares are currently experiencing record lows and its shares now trade below $2. Moreover, AMD shares were worth over $4.50 this time last year, thus experiencing a 60% deterioration in a twelve-month timeframe.

(Figure 3: Yahoo! Finance)

AMD are clearly in a very bad shape but the encouraging sign for investors is that there is very little potential for shares to fall further, and, that is not just me being optimistic, it is a realistic too. Small $2 stocks, especially from former big tech companies, can potentially move 10-20% in a few months and the chart above illustrates the high volatility of AMD stock in the past.

The scope for AMD to fall further is not very large and is far outstripped by the vast amount of upside potential AMD stocks have if current reformations are successful and the company manages to turn the their fortune around. The consensus amongst analysis is that AMD stocks will inevitably rise in the near future and their mean price target is $2.30 – a 27% rise. Realistically, Advanced Micro Device shares could fall further but their current record low make the prospect of their value increasing exponentially higher and more lucrative.

Takeover Potential

Now that AMD shares are valued at less than $2 their current market cap is just $1.4 billion making it a relatively cheap target for a potential merger or acquisition.

Back in January, AMD were rumoured to be the subject of a takeover bid by Chinese firm BLX IC Design – a leading fabless microprocessor. BLX and AMD have collaborated successfully in the past including opening a Beijing-based Computing Development Center in 2013. Similarly, Samsung were rumoured to launch a takeover bid for AMD back in March. Both these rumours never materialised and lots of analysts believe that multiple companies and investors have kept away from AMD due to a cross-license agreement with Intel. The cross-license agreement is allegedly terminated when one of the parties changes ownership or control, AMD would thus lose legal rights to build x86-compatible processors.

However, AMD’s Chief Financial Officer, Devinder Kumar, alleviated these fears back in May. Kumar stated that Advanced Micro Devices is able to enter joint ventures and mergers or acquisition agreements without fear of the termination of the cross-license pact with Intel.

Due to the CFO quelling any fears of any contract terminations and their current low market cap, AMD is starting to look like an alluring acquisition target for tech companies.

Conclusion

Advanced Micro Devices current financials and recent stock price movement looks depressing. However, inroads into the gaming market through the production of new GPUs, the present low stock price and the likelihood of a takeover bodes well for the future of AMD.

I Know First’s algorithm correctly predicted the devastating drop in Advanced Micro Devices shares back in May 2014 when a bearish forecast was against the grain. The current Algorithmic analysis is quite bullish, particularly for the long-term, which is a courageous prediction considering most analysts are sceptical regarding the stock as a result of its high volatility and the company’s financials. Nevertheless, due to the algorithm’s notable success in predicting ADM’s stock movement in the past and the aforementioned fundamental analysis, I believe AMD stocks will inevitably rise and the current low price makes the potential opportunity highly lucrative.

In this one-year forecast from May 29th, 2014, AMD had a strong bearish signal strength of negative 272.46 and a predictability indicator of 0.39. In accordance with the algorithm’s prediction, the stock price decreased 43.00% during that time.

(Figure 2: AMD forecast May 29th ’14)

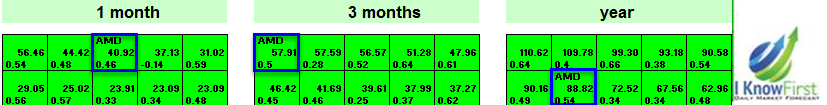

More recently, I Know First published a bullish article on AMD, a global semiconductor company, on Seeking Alpha. Having explained how I Know First’s algorithm works and providing an example of its success in the past, it is worthwhile to see if the algorithm agrees with the bullish fundamental analysis of the company. The one-month, three-month and one-year forecasts for AMD are illustrated below.

(Figure 3: AMD forecast 21st July ’15)

The above forecast is the most-recent forecast from June 15th 2015 and is for the long-term period of one year. The forecast is consistently bullish amongst all three long-term time frames with high signal strengths of 40.92, 57.91 and 88.82 being attributed to the one month, three months and one year time frames. The algorithm evidently predicts that AMD bullish forecast gets stronger as time progresses.

The algorithmic analysis correlates with the I Know First Research bullish fundamental analysis contained in the aforementioned Seeking Alpha article. The current low stock price and inroads into the gaming industry leads the research team to believe that AMD has lots of lucrative upside potential. Due to the algorithm’s notable success in predicting ADM’s stock movement in the past and the aforementioned fundamental analysis, I believe AMD stocks will inevitably rise and the current low price makes the potential opportunity highly lucrative.

Positive signal strength does not mean investors should automatically buy the stock. Dr. Roitman, who created the algorithm, created rules for entry for a stock such as Gilead Sciences. Using this trading strategy, an investor should buy a stock if the last 5 signal strength’s average is positive and if the last closing price is above the 5-day moving average price. When both of these conditions are met, it is a good time to initiate a position in the stock.