Tesla Stock Prediction: Tesla’s Pullback Is A Buying Opportunity

![]() Naman Shukla is an Analyst at I Know First. He writes and invests in the stock market. Ranked in the top 8 percentile in TipRanks.com. Featured on SeekingAlpha.com, GuruFocus.com, Valuewalk.com among others.

Naman Shukla is an Analyst at I Know First. He writes and invests in the stock market. Ranked in the top 8 percentile in TipRanks.com. Featured on SeekingAlpha.com, GuruFocus.com, Valuewalk.com among others.

Tesla Stock Prediction

Summary:

- The new P100D version is a lot better than its predecessors and will attract new buyers.

- The Model S, like the Model 3, will be a hit among Tesla buyers.

- The company’s presence in the Chinese market represents huge growth potential for long-term investors.

- Tesla’s recent pullback should be seen as a buying opportunity.

- I Know First maintains a bullish position regarding Tesla Motors Inc.

Tesla (TSLA) has had a rough few weeks due to several concerns. Be it the potential acquisition of SolarCity, bearish stance of Jim Chanos, or the recent Elon Musk E-mail incident, Tesla’s shares have dropped considerably from the 52-week high levels.

While bears keep arguing about the aforementioned points, I think the recent pullback is a great buying opportunity for long-term investors. There are several reasons why I think Tesla is a great buy at these levels that are described below.

A new and upgraded P100D version

At present stage, autonomous cars market and virtual reality market accounts for the two rapidly emerging markets and Tesla is one of the most significant players in the former. Recently, Tesla announced its new Model X and S based on P100D version. These new models are fortified with a new 100 kW-hour battery. As a result, this extended the maximum range of both the vehicles considerably.

(Source: Tesla)

With the use of this new battery, Model S and Model X will be able to run 315 miles and 289 miles, a surge of 21 miles and 32 miles, respectively. These numbers may seem feeble, but one should also keep in mind that the previous records were accomplished by the company’s 90 kWh Model s and X options without its ludicrous acceleration.

However, when Tesla upgraded the performance of Model S and X, and equipped them with Ludicrous mode acceleration, the rated ranges were 270 and 250 miles, correspondingly. All in all, the company’s new 100 kilowatt-hour battery surged the range of similarly optioned Model S and X vehicles by a stunning 17 percent and 16 percent.

To achieve P100D, the company turned its Ludicrous mode acceleration even better. Eventually, a P90D grounded on Ludicrous mode acceleration was able to achieve 60 mph from 0 mph in 2.8 seconds. However, Tesla’s new P100D is capable of accomplishing 60 mph in just 2.5 seconds, making it the third fastest production car ever manufactured.

Cheaper Model S

Tesla realized that the customers love its products, but are also seeking for a cheaper vehicle. Therefore, the company introduced its new cheaper variant of Model S, almost at the end of second quarter. It is equipped with 60 kWh hours of battery capacity, together with an extra 10 kWh of capacity for a fee thru an over the air software update any time after purchasing the vehicle.

This new Tesla’s Model S starts from $66,000, approximately $5,000 less compared to its prior base model. This new Model S was crammed with value and signified an aggressive step for the rapid-growing auto manufacturer.

However, this new model was launched at the end of second quarter. Therefore, no orders were delivered in the second quarter, and any advantage from the demand created by this new Model S would be delivered in the imminent quarter.

It is still not clear how this less expensive Tesla’ Model S will affect the company’s sales, but the company detailed that it launched this new model because it saw more Model 3 demand than it anticipated, which is evident from the image below.

(Source: Business Insider)

Moreover, the company has reaped 373,000 reservations for its new Model 3 in just two weeks since the launch of vehicle in March. Therefore, a trivial portion of this market could be a substantial driver for Model S.

Competition is rising at a rapid pace

As a matter of fact, the automotive segment has been crowded with many well-known auto manufacturers. Almost every established automaker is heading towards EV market, some with more passion than other players.

It appears like giant players such as Audi, Mercedes are moving ahead with a prodigious deal of risk avoidance. This means that they are not going to have competitive cars on the road in the near term.

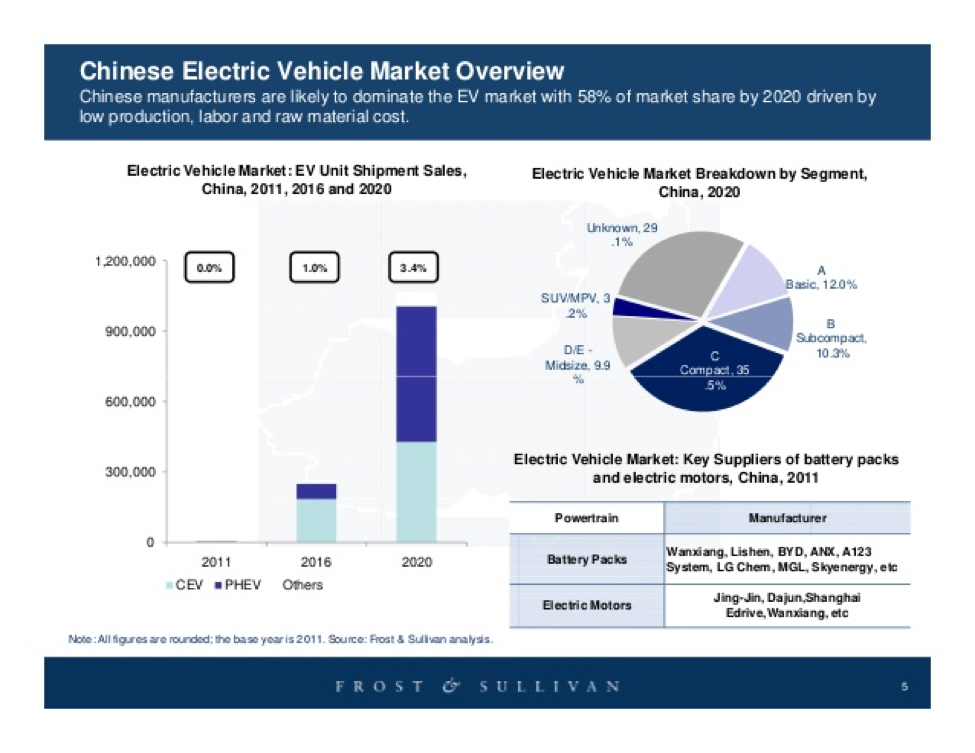

Furthermore, automotive companies present in China are more likely to provide a direct threat to Tesla being capable enough to establish itself in Asia in an expressive way.

Despite all the threats possessed by the Chinese automakers, there is plenty of room left for Tesla in China. In 2015, EV registrations in China surpassed those in the Unites States. Moreover, it is projected that the market for EVs and hybrids in China will mount by approximately 50 percent per year for the upcoming ten years.

(Source: SlideShare.net)

Given the market potential and Tesla’s ability to outdo its rivals by making great products, I have no doubt the company will perform better in the long run.

Conclusion

I expect Tesla to reverse the recent downtrend on the back of strong demand and growth across several markets. Even though the stock is hovering around $200, I think investors should consider accumulating it on the pullback.

My bullish stance on TSLA is resonated by I Know First’s algorithmic signals. As you can see from the image below, the green 39.18, 100.77, and 233.90 forecasts indicate that I Know First’s algorithm expects Tesla to perform well in the short as well as long term.

Past I Know First Forecast Performance on TSLA

I Know First has been bullish on Tesla Motors Inc. in past forecast. Since then, TSLA has been up 38.04% to date.

This forecast was sent out to I Know First subscribers on February 10th, 2016. To subscribe now click here.